I have a decent grasp of the technology and utility of blockchains. I think that digital currencies add value to our world. And I think they will be here to stay.

If you can feel comfortable that the entire blockchain ecosystem isn’t a scam—a BIG IF given that Warren Buffett is convinced that Bitcoin is a Ponzi scheme – then Silvergate (NYSE:SI) is a great way to ride this trend.

I first heard about Silvergate nearly a year ago from the newsletter of my favorite journalist, Matt Levine.

On the surface, Silvergate is a bank. Their core business began by taking customer deposits and doing boring bank things like investing in municipal bonds.

Silvergate has actually been around for 40+ years, and they were one of the first banks to serve the digital currency industry 2013.

Since that time, Silvergate has pivoted to focus 100% on digital currency customers, carving out a nice niche for itself.

What makes Silvergate truly special is the Silvergate Exchange Network (SEN). SEN lets Silvergate’s customers transfer assets to one another instantly around the clock. It creates a classic network effect, and Silvergate has first-mover advantage.

Some of Silvergate’s core customers are the digital currency exchanges who actually handle crypto assets.

Think of it like this: SEN is an exchange for those exchanges. It also serves the broader ecosystem of crypto investors, developers, miners and more.

No other bank has the SEN. It would be difficult to replicate today, and that difficulty is only going to increase over time.

Imagine if JP Morgan owned the NYSE, and the NASDAQ didn’t exist. That would be a very powerful bank.

Silvergate is a bet on crypto without having to choose any specific currency. Silvergate has a strong brand in the digital currency world. They are headquartered in San Diego, and they generate real profits with real $USD.

Risks:

In general, the world of digital currency seems to attract a lot of young, sketchy, self-promoters. With Silvergate, however, management seems scrupulous. They have decades of experience and lots of gray hair.

Silvergate’s interest-yielding loan portfolio looks boringly vanilla which is what their depositers and investors should want. Plus, they have great relationships with banking regulators – with whom they’ve collaborated closely from the beginning.

The real risk is that the entire cryptocurrency ecosystem is a house of cards as Warren Buffett asserts. I disagree with the Oracle of Omaha here, but you must decide for yourself.

Valuation & why now:

Silvergate is profitable. But looking at the profits alone would obscure the underlying growth.

Here is the quarterly growth of activity on the SEN, as measured by the volume of cash transactions amongst the bank’s customers to one another.

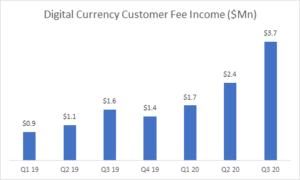

And here is the associated fee income generated by digital currency customers.

One note: Q3 digital currency customer fee revenue has not yet been officially released (Earnings release on 10/26). $3.7M is my estimate based on Silvergate’s October 6th press release.

For comparison, Q2 net profit for the entire company was $5.5M, so ~$1.3M sequential growth in this revenue line item is very meaningful to the bottom line.

As fee revenues continue to grow, the market will be forced to realize that Silvergate is not just a bank. It has something that few banks have – a network effect.

As I write this, the stock has run up 30% this month and sits at an all-time high.

It’s still quite cheap. You are paying around $15 for $1 of net income today.

But if you think digital currency fee revenue can continue to grow 100%+ a year for the next few years, then you would be paying $5 today for $1 of net income in year 3.

(August 2020 Silvergate investor deck, Coindesk September 2020 Research Report on Silvergate)

Why I write about my portfolio

I want you to challenge my beliefs. I’d love for you to tell me what I’m missing. I want you to tell me about public companies that I may not know about. And I’d love for you to teach me more about the companies that I already know.

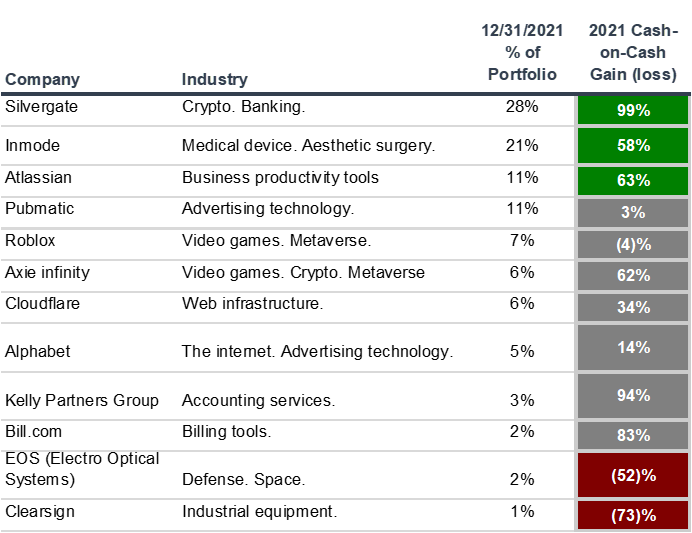

As of 9/30/2020, Silvergate was the 4th largest position in my personal portfolio.

I bucket the company as a “Hidden Gem”. Next article, I dive dive into another Hidden Gem – Electro Optic Systems.

Drop me a line if you have any questions / comments or just want to get in touch! yz@yishizuo.com

Disclaimer: I am not a registered investment advisor. Nothing I write should be construed as investment advice or the solicitation of investment.