Has there ever been a more spectacular start-up failure than Quibi in 2020?

$1.4 billion down the drain. Total shutdown merely 6 months after launch.

Quibi built a product without understanding the customer’s needs.

It’s a common start-up mistake–one that I’ve made myself.

This mistake comes with a catchphrase: “Solution looking for a problem”.

It’s similar to another common saying: “To the man with a hammer, everything looks like a nail.”

In the investing world where I started my career, this hammer and nail analogy has a specific meaning. It implies that the world is complicated and that you shouldn’t overfit your existing mental models to make sense of a new situation.

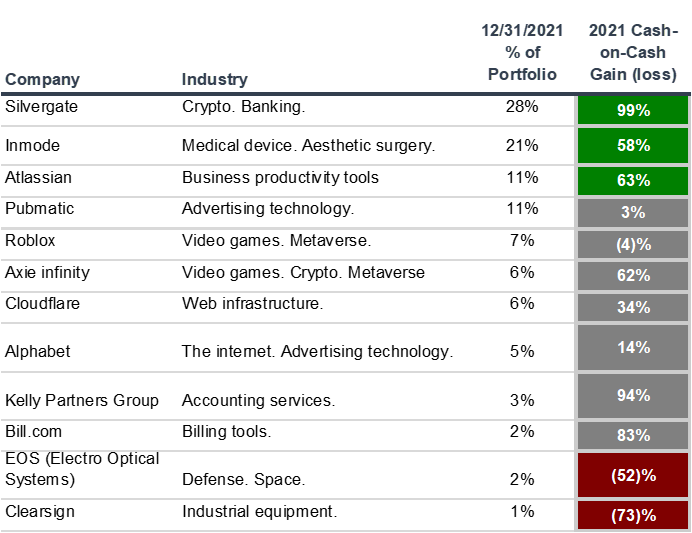

Warren Buffett’s purchase of See’s Candies in 1972 is the exemplar of an investor successfully expanding his mental toolkit to avoid “the man with a hammer” fallacy.

Prior to See’s, Buffett’s style was to invest in crappy businesses at prices so low he couldn’t lose. This was the traditional value investment approach, also known as Cigar Butt investing–where one looks for abandoned cigar butts that have a couple puffs of value left.

However, the upside for these cigar butts wasn’t very high either.

See’s Candies was a pricey acquisition, but it was an even higher quality asset. And the true value of this relatively small acquisition is that it opened Buffett’s eyes to the sweet benefit of investing in higher quality businesses.

“If we hadn’t bought See’s, we wouldn’t have bought Coke. So thank See’s for the $12 billion [gain].”

Warren Buffett – 1997 Berkshire Hathaway Annual Meeting.

Making the connection and taking action

Very few people publicly think about the combination of value-investing and entrepreneurship as I do.

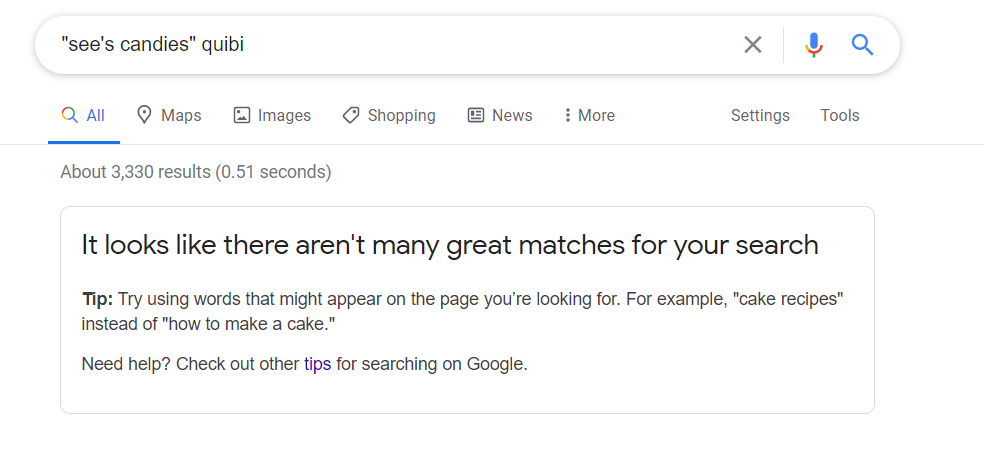

For example, I think I’m the first person in the world to ever mention Quibi and See’s candies in the same article.

To me, the general lesson from these two examples is clear: “Don’t go down the wrong path.”

This is easier said than done.

As an entrepreneur, at a certain point, you must start thinking about a solution. Having a solution helps narrow the problem, and it helps you better convey your vision and get alignment from investors, teammates, and customers.

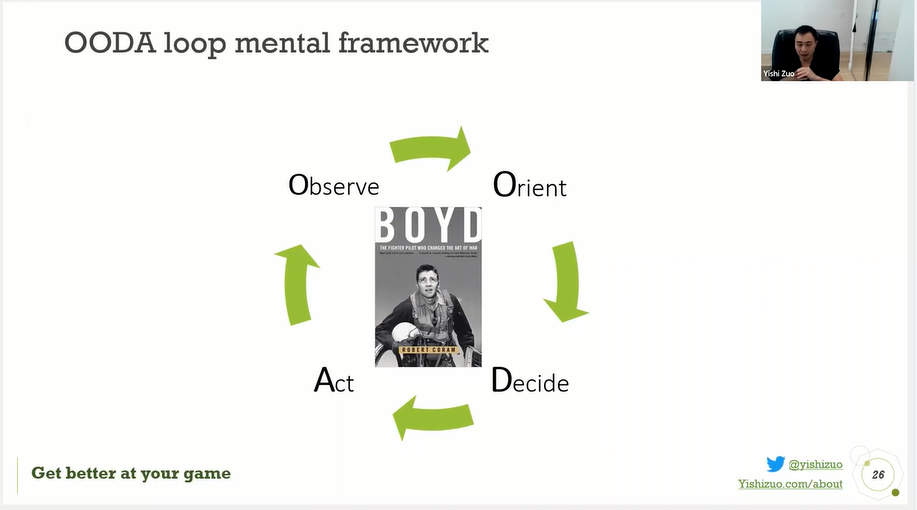

And as an investor, you must simplify. As the famous saying goes: “All models are wrong, but some are useful”.

Even if no model is perfect, the world is too complex to operate without them. Evolution has programmed our brains to use mental models to conserve energy.

The critical questions are:

- When and how do you jump to a solution as an entrepreneur?

- When and how do you simplify as an investor?

I can’t answer these questions for you because the best answers are situational and individual-dependent.

But effectively answering these questions is the core determinant of being either a great entrepreneur or a great investor.

Given my background, I have a unique perspective here. And the good news is that over time, through accumulated experience and wisdom, we should both get better at making those tough decisions.

So sign up for my newsletter below and let’s learn together!

I write at the intersection of investing, entrepreneurship and personal growth. Contact me at yz@yishizuo.com. I respond to all thoughtful messages.