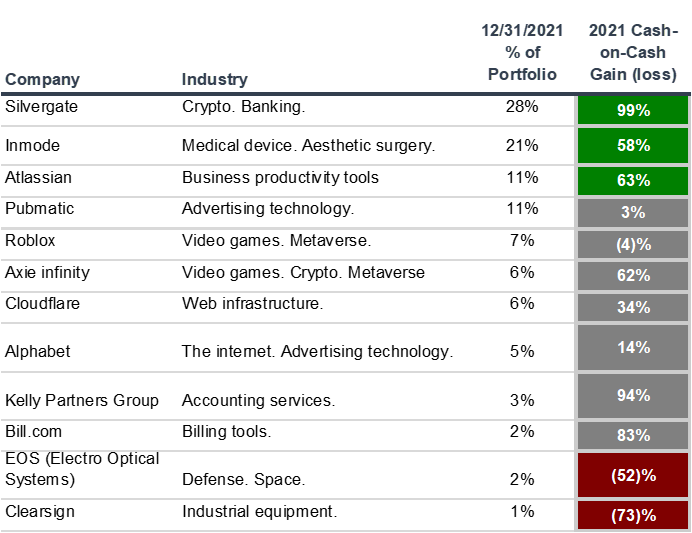

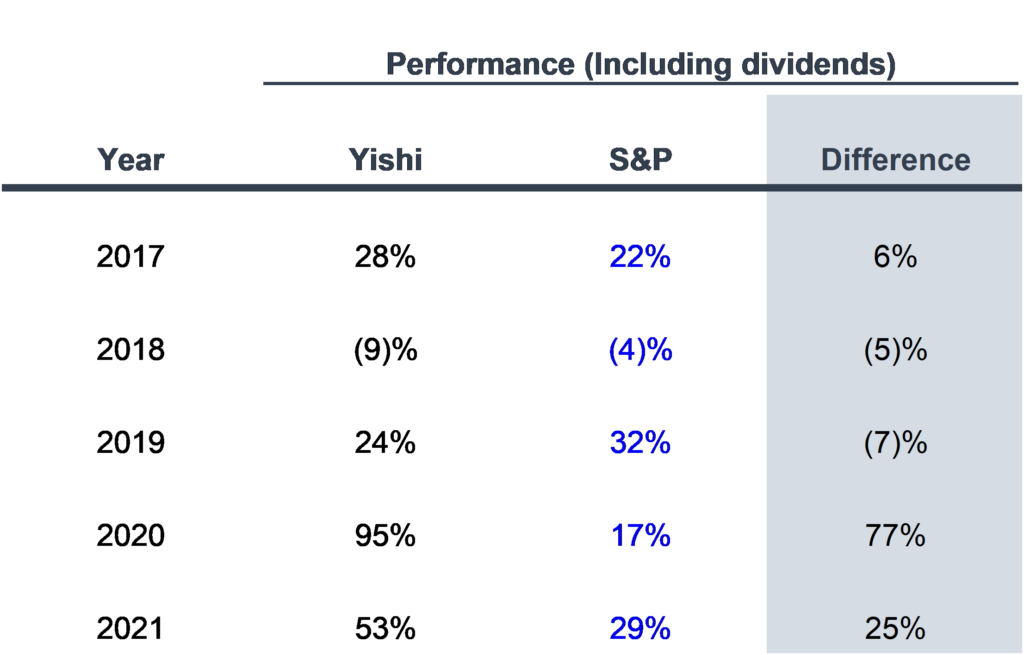

My portfolio returned 53% in 2021, vs. 29% for the S&P.

Here is a closer look:

Disclaimer: I am not a registered investment advisor. Nothing I write should be construed as investment advice or the solicitation of investment. This is for educational and entertainment purposes only.

Notable winners:

Overall, my biggest positions performed well.

Silvergate more than doubled this year. I wrote about this company in October 2020 and January 2021. My predictions have continued to play out as expected.

Silvergate is a gateway from fiat currency to crypto for institutional investors and crypto exchanges. You can think of it as critical infrastructure. They face limited exposure to crypto price volatility. They enjoy network effect as well as first-mover advantage.

Major exchanges such as Coinbase and Kraken are Silvergate customers. Projects such as Visa-backed Anchorage and Meta-backed Libra are customers. They also work with smaller players who may become tomorrow’s giants.

And given their historically proactive approach to government relations, Silvergate is well-positioned as regulatory scrutiny increases in crypto.

Rank: #1 @ 28% of portfolio as of 12/31/2021

InMode tripled this year.

Throughout the year, I thought it was cheap relative to its growth potential. So I bought shares along the way up. And now, it’s my 2nd biggest position.

InMode sells aesthetic surgery tools. They sell various base machines, and they also sell consumables. (Think razor & blade model).

There are several competitors in the space, but thanks to superior management, InMode has the best product and the best sales & marketing execution in a fast-growing industry.

For more information – read my friend Jay Vasantharajah’s prescient write-up in August 2020.

One of the reasons I feel comfortable going big here is my experience investing in another company called Sodastream many years ago. Sodastream sells at-home sparkling water-makers. It was acquired by Pepsi in 2017. That investment was a big win & learning experience for me.

Sodastream and InMode operate in completely different industries. But just like Sodastream, InMode has Israeli roots, a relatively simple business model, and enjoys terrific razor-blade unit economics.

Rank: #2 @ 21% of portfolio as of 12/31/2021

Atlassian is up 60%+ this year. This is one of my longest-term holdings. And it is up ~6x since I first purchased the stock in 2018.

Atlassian sells project-tracking / productivity tools. Their target customer is engineering & product teams. There are competitors, but Atlassian’s powerful suite of tools are the most prominent. And their freemium pricing & distribution strategy is a winner.

It’s great to be in a fast-growing market as the market leader, with brand recognition and significant switching costs.

Atlassian is still a founder-led company. And their founding story was a key part of my initial thesis. The story is a bit better known now, and for more information – read this recent interview of Atlassian’s founder, written by my friend Tom White.

Rank: #3 @ 11% of portfolio as of 12/31/2021

Notable losers:

My major losses all happened to relatively small positions in the 3-4% range.

Electro Optic Systems (EOS) – I wrote about Australia’s leading defense contractor last November.

A core part of my thesis is that they have a call option on the Space sector that doesn’t expire.

By definition, a call option that doesn’t expire doesn’t require additional capital. That’s where I was wrong

I didn’t realize just how much capital is required for their Space efforts. EOS announced that they would seek to raise $400M USD for its wholly owned, US-headquartered subsidiary, SpaceLink. This is more than EOS’s market cap.

Supposedly, EOS / SpaceLink has a strong IP advantage. For those of you who are wondering, SpaceLink does not compete against SpaceX—the type of communication is very different. For more information – check out this investor presentation from October 2021.

The key difference between EOS / SpaceLink and a pureplay space-tech company is that the Australian parent operates a profitable, mission-critical defense business that should grow nicely given the geopolitical trends mentioned in my previous article.

Nevertheless, EOS’s stock is down 60% YTD. My hunch is that the magnitude of capital requirements and the extreme uncertainty around potential outcomes are making Australian public market investors nervous. As far as I am aware, there is no publicly-traded defense contractor that is making a VC-type bet like this, at this relative scale.

ClearSign is another VC-type bet I made recently. The company plans to sell emissions control equipment.

I invested around the time my friend Marcel Gozali wrote this article in June 2021.

ClearSign was supposed to launch a pilot with Exxon Mobil which got shuttered.

Subsequently, the stock price got crushed. Since my purchase, the stock price is down 70%+.

This reminds me of a company I looked at years ago in the industrials space called Horsehead Holdings.

Both Horsehead then and ClearSign now face binary outcomes.

The difference is that Horsehead was essentially a commodity producer. It had much higher capital requirements, and it went bankrupt.

ClearSign is more of a regulatory trend / picks & shovels type of play.

While Clearsign is still alive with cash on hand and has other pilots in progress, bankruptcy + dilution could very well happen here too.

A thought on value-investing.

I’ve been actively investing in stocks for ~10 years.

I used to work for a hedge fund that taught me fundamental analysis. We looked for stable businesses with predictable cash flows. This style of investing is what most industry insiders would call traditional “value-investing”.

Since then, my personal investment style has evolved.

Simplistically, you can call what I do momentum / growth investing; however, I’m trying to find growth that is underappreciated by others. I define value-investing as buying something for less than its intrinsic value. So I think of what I do as “value-investing”. And by my definition —all investing is an attempt at value investing—and of course, not all attempts will succeed!

Overcoming my own psychology, and some notable exits

I had a conversation with my aforementioned friend Marcel earlier this year that made me question my approach to stock investing.

After some reflection. I realized that a colossal investing mistake I had made years ago was still holding me back mentally. I had become too conservative.

At the beginning of 2021, there were some stocks that I was holding onto less due to logic and more due to emotion—status quo bias as well as psychological safety.

Equinix was a prime example. It’s a fantastic business—essentially an unregulated global telecom monopoly with a network effect that will continue to grow 10%+ / year for many years to come.

It was our largest position for years back at the hedge fund I worked at, and I had personally bought and held Equinix for many years after leaving that fund.

This year, I decided that investing 15%+ of my portfolio in Equinix was playing it too safe.

While there are still some misunderstood factors, the company is better known than ever, and the range of potential outcomes is much tighter.

I had told my parents to invest in Equinix years ago. And thankfully they listened. That’s plenty of exposure to this business for my family already. So after 5+ years of buy & hold, I sold all my Equinix shares.

For similar reasons, I jettisoned my positions in Constellation Software and Match.com – not because they are bad businesses — they are fantastic – but because there are less unknowns now, more growth is priced in, and the ranges of potential outcomes are much tighter.

Finding my sweet spot and getting comfortable

One of my key goals as an investor is to never lose sleep over stock prices.

Generally, my most painful mistakes have resulted from poor entry-sizing as well as doubling down on bad bets.

Each year that passes, I become wiser. I now feel more confident in my ability to make good bets and stomach higher volatility. Hence, I’ve reduced my total number of positions and concentrated 70%+ of my capital in my top 4 positions.

I’ve also spent some time thinking about what has led to my big wins as well as missed opportunities in years past.

I realize that my sweet spot is in companies that are already growing rapidly.

- People don’t fully appreciate the underlying drivers of growth.

- There is opacity and uncertainty around how long that growth can last.

- Usually, there is something innovative happening that is changing the status quo—either in the industry, or the company itself.

In short, I’m watching out for great businesses that are less understood. They tend to skew B2B, with smaller market caps and some kind of structural advantage.

Read on for a hint of how I think – with live examples based on 6 new purchases I made this year.

New purchases in 2021

Alphabet – So this is far from an unknown, small-cap company. But investing is all about finding the exceptions. Alphabet is growing at an astonishing rate for a business so big. Despite the law of large numbers, I don’t see growth slowing. And from a valuation perspective, they are still reasonably cheap.

Kelly Partners Group – This is a small-cap Australian CPA roll-up. The founder CEO’s communication style reminds me of great capital allocators like the Warren Buffetts and Mark Leonards of the world, so there is some pattern-matching I’m doing there. So far, Kelly Partners’ financial results have been solid. It’s not the most complex business. I like its unit economics and the lack of correlation with the other businesses that I own. And because of its size and obscurity, its valuation is reasonable.

Cloudflare – Byrne Hobart wrote an essay in April 2021 that turned me onto Cloudflare’s unique structural advantages & culture. It led me to do some digging, and I came across Muji’s newsletter. I learned about edge networks, and it opened my eyes to how Cloudflare uses its structural position to enter new markets—expanding its Total Addressable Market (TAM). Cloudflare operates in a complex, high-tech ecosystem. So despite its valuation & size, I don’t think it’s fully understood by the market.

Pubmatic – A friend told me about this company recently. After doing some research, I pulled the trigger relatively quickly and made it my 3rd largest position, equal to Atlassian. Pubmatic is founder led, well-run, and enjoys structural cost advantages. I don’t think value is fully reflected in the price because of uncertainties around consumer data privacy restrictions and biases that investors have against ad-tech. There are a few YouTube interviews of the CEO, such as this one – worth watching if you’d like to learn more.

Roblox – This is a video game company growing rapidly in a sector with a lot of hype —the metaverse. Facebook is eyeing this space so hard that it changed its name to Meta. 😂 I’m less worried about the competition, partially because I don’t think investors fully understand how big the metaverse opportunity is. In January 2021, I wrote an article titled GameStop’s Moral Mandate – Go Big or Go Home about how GameStop should use its newfound wealth to aim for the metaverse. Despite my bombastic rhetoric, I wasn’t joking. I think virtual worlds are a huge opportunity, and I’ve put my money where my mouth is.

Axie Infinity— This is my most unique position. You can’t buy Axie Infinity on a stock exchange, but you can buy it on Coinbase. Axie Infinity is a video game company masquerading as a crypto / NFT project. It’s the leader of a new “Play to Earn (P2E)” model. There is a Metaverse component to this as well. Roblox and Axie Infinity are coming at this from very different angles—and I think there will be many winners in this space. For more information, see this overview presentation I created for a small group of friends last month.

Final thoughts and appendix

I love the game of long-term stock investing. Not only does it sate my curiosity, but it also pushes me mentally.

When I push myself to my limits, I risk making mistakes. And yes, I have made costly mistakes before. But after each mistake, I learn something new about myself. And I get better, not just as an investor, but also in overall emotional maturity and life wisdom.

So financial investing is an area where I do want to keep pushing myself.

Subscribe and join me on a journey of personal growth.

Disclaimer: I am not a registered investment advisor. Nothing I write should be construed as investment advice or the solicitation of investment. This is for educational and entertainment purposes only.