**Update January 2021** – 2021 results have been published.

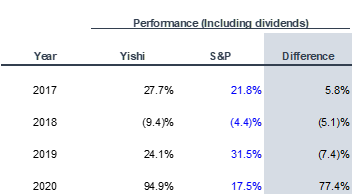

I left my full-time hedge fund job in May 2016. Subsequently, 2017 was my first full year of investing without constraints, and here are my results:

While 2020 turned out well—2017, 2018, and 2019 were mediocre—when I underperformed the market on average.

Extreme pessimism & extreme volatility – a look back at March 2020 + Lesson #1: Cash on hand is king

In mid-March, we were afraid. The NBA season was canceled. A vast swath of the planet was in lockdown. The S&P 500 had dropped precipitously.

But was the market behaving rationally?

I wasn’t sure, but I started researching. And here is a tweet that helped me answer the question:

$PSA preferreds 5 bucks under par is not realistic unless half the population is going to die. JMHO

— Volte-Face Investments (@VolteFaceInvest) March 23, 2020

Translation: “Certain stocks are being priced by the market as if half the population is going to die.”

I never did verify if what this anonymous fella said was true, but I had a hunch that he was closer to being right than wrong.

For me, this was one of several signals screaming at me, yelling that the market was being irrational.

As deadly as coronavirus is, a 50% fatality rate was not a realistic scenario.

This told me that opportunities in the market were ripe for the picking.

And the more I looked, the more I realized that it was a fantastic time to buy nearly any stock.

I wasn’t sure how much time I had to take advantage of this, and I wanted the best risk-adjusted deal. So I looked for something:

- I could easily understand

- Had dropped 50%+ in price from pre-COVID levels

- Had a high likelihood of recovery

- If I bought, it would pay me a dividend to wait in case the market stayed irrational for a long period of time

I had no idea when we would develop a vaccine, and I had no idea when the shutdowns would end.

But I knew that people needed to eat—and I could see with my own eyes, when I went shopping for food, that grocery stores were doing better than ever.

I stumbled across Slate Grocery REIT (TSE: SGR.UN). It owns grocery-centered real estate properties in the suburban United States. It was paying a whopping 16% dividend yield, with a solid balance sheet to back it up.

Slate Grocery REIT checked all the boxes. And I added it to my portfolio in March.

Silvergate – a highlight of luck or skill? + Lesson #2: Patience pays off

For me, another highlight of 2020 as a stock investor was Silvergate (NYSE: SI), a bank that serves the crypto industry.

I bought the stock a week after the IPO in November 2019. It started as one of my largest positions, and for nearly a year, the stock went nowhere.

But over the past 4 months, Silvergate has more than quadrupled.

While it doesn’t hurt that crypto is experiencing a resurgence and Bitcoin is at all-time highs, Silvergate’s intrinsic value is not tied to the price of any cryptocurrency.

Over the next 3 years, I have no idea:

- Which coins will do better than others,

- How many crypto market crashes there will be,

- When they will happen, or

- How severe those crashes will be

And I don’t need to know. I am reasonably confident that as long as the crypto ecosystem doesn’t crash to 0, Silvergate will be a valuable business for years to come.

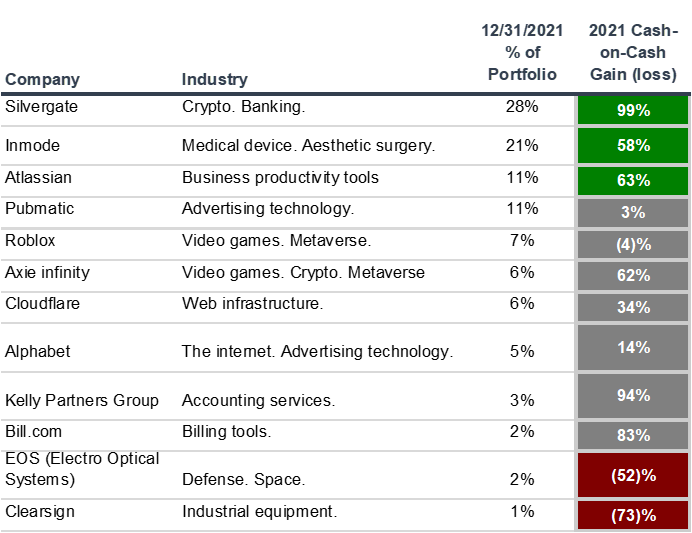

Q4 (Oct – Dec 2020) portfolio update

I made 0 stock transactions in Q4 2020. (It’s not uncommon for me to go months without making any trades)

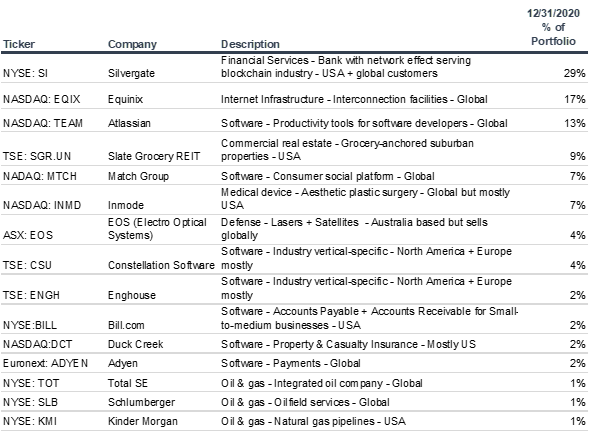

But my portfolio composition has changed given the general increase in Silvergate’s stock price. The company went from my 4th largest position at 8% of my portfolio at the end of Q3 to my top position at 29%.

How I think about risk + Lesson #3: You get to choose the game you play

At the end of Q3 2020, why did I only allocate 8% of my portfolio to Silvergate, and more than triple that in Equinix?

The answer is personal risk preference.

I’d wager that there is a 50% chance in the next 10 years that the entire crypto ecosystem will go to 0.

Worst case scenario: Silvergate goes bust—losing 8% of my portfolio would be bad but not disastrous.

I face plenty of volatility & risk in my full-time career as a tech entrepreneur / early stage investor. And there are plenty of challenges to keep me busy.

What would be a true disaster is if my stock portfolio becomes a distraction, affects my career, generates stress, makes me lose sleep, or diminishes my quality of life.

Therefore, there are non-monetary benefits to owning less volatile companies.

That mentality may affect my long-term stock returns, but that’s not the only game I’m playing.

Disclaimer: I am not a registered investment advisor. Nothing I write should be construed as investment advice or the solicitation of investment.

About the author: I enjoy discussing business topics with friends & strangers. Shoot me an email yz@yishizuo.com – I respond to all thoughtful messages.