Years ago, when I worked as a hedge fund analyst, I dove deep into the satellite + space imaging industry.

The most interesting thing I learned was that space debris is a huge problem for humanity.

This scene from the movie Gravity demonstrates the problem pretty well.

Orbiting space debris travel 7x faster than bullets. And at that speed, even small paint chips can cause a lot of damage.

Every time we launch anything into space, debris naturally accumulates. And the problem grows exponentially.

EOS – a defense company working on the space debris problem

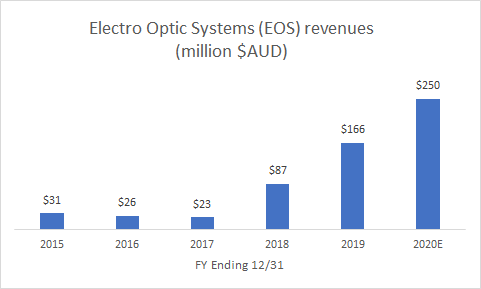

In 2014, I discovered Electro Optic Systems (EOS) via a news release that this tiny Australian company signed an agreement with Lockheed Martin—the giant US defense contractor—to tackle this issue.

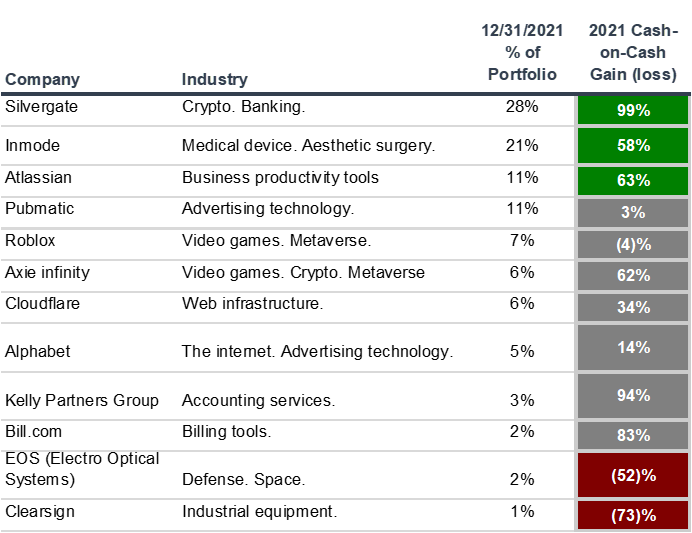

EOS is listed on the Australian stock exchange. As of 9/30, it comprised 5% of my portfolio. Not only does the company track space debris, it also enables space communication,

However, both those items are a small portion of EOS’ business. Communications was 11% of first half 2020 revenue, while space debris tracking was a negligible 1%.

At its core, EOS is a defense business (88% of its revenue) at the forefront of modern warfare.

It sells Remote Weapons Systems (RWS) –automatic guns mounted on vehicles. And it sells Counter Unmanned Aircraft Systems (CUAS)— lasers that destroy drones.

Over the past 4 years. EOS’ Revenues have increased dramatically, driven almost entirely by the popularity of its remote weapons systems.

Geopolitical tailwinds that help EOS

EOS sells its products globally beyond Australia. They sell to the US and countries allied with Australia and US. 59% of 2019 revenue came from the US, and 27% came from the Middle East.

The company is fortunate to benefit from America’s changing geopolitical stance.

For better or worse, America’s allies are realizing that they need to fend for themselves and invest more in their own defense.

Whether Biden defeats Trump – now that the seal has been broken, the genie cannot be put back into the bottle.

This is quite the favorable trend for EOS—the national champion of Australia’s defense sector.

Risks

Of all the companies in my portfolio, EOS is the most dependent on advanced technology.

3 interesting assertions from the company:

- Its remote weapons systems and anti-drone systems are the best.

- It is reaping the reward of many years of R&D.

- Much of its leading technology is fueled by research derived from their space business.

Today, these statements are being proved out in their financial results.

However, it’s hard to get comfort on how durable their technology is.

On the other hand, your technology risk as an investor in EOS is mitigated by the nature of defense procurement procedures, which are quite onerous and result in a huge barrier to entry.

Governments can’t buy this stuff from just anyone. Not only are lives at stake, but the existence of the nation is also at stake.

Success in the defense sector requires trust, which can take decades to build. There is a lot of information-sharing that happens in order to design a cohesive product. Fortunately, EOS was founded nearly 40 years ago and it has those critical relationships in place.

A more pressing risk is EOS’s relatively small size. While the company is profitable, earlier this year, COVID wreaked havoc on production and deliveries. As a result, EOS faced a cash crunch and had to raise dilutive equity.

Valuation

The company has a sizable and growing backlog (A$570 million as of 6/30). Backlog generally means orders placed but not yet paid for because the orders either a) have not yet been produced or b) have been produced but not yet delivered to the customer.

The company is also tendering for A$3 billion of new orders. “Tendering” refers to the process by which EOS and other companies bid on new projects. If EOS wins the tender, then revenues move to the backlog. Petra Capital, a 3rd party research firm, indicates that historical tender win rates are around 25-40%.

I don’t think it is unreasonable that revenues can grow 50% a year for the next 3 years. And if you assume a 10% margin, you are paying $10 today for $1 of net income in year 3. That is slightly cheaper than the much larger US public defense companies.

What I like about EOS is that that you get a free call option on the space-related business – which is what first caught my attention years ago.

The flourishing defense side of the business reduces your risk and pays you to wait. EOS like a VC investment with a non-binary outcome. It’s a call option that does not expire. It aligns with my philosophy of upside optionality.

Lastly, beyond the standalone value of EOS, I like the company even more in a portfolio context.

EOS is a hedge against bad things happening in the world—(i.e. global conflict, or satellites exploding). And it is uncorrelated with the other stocks in my portfolio.

Parallels between space debris and COVID

For decades, just as experts have warned about a potential global pandemic, so too have other experts warned about the dangers of space debris.

It’s the same type of problem—simultaneously inevitable and unpredictable. And the problem will not be cheap to solve.

At the rate we shoot things into space, near-misses are now common place. The problem is growing exponentially, not linearly. And it’s just a matter of time before something disastrous happens.

There are several private companies, as well as a couple of large American defense contractors working on the problem. And I am optimistic that human ingenuity can solve this problem.

I’m betting that EOS will have a part to play in that solution and be rewarded for the value that they provide. But even if I’m wrong on that, I’ll have a profitable and rapidly growing defense business in my portfolio.

Why I write about my portfolio

I want you to challenge my beliefs. I’d love for you to tell me what I’m missing. I want you to tell me about public companies that I may not know about. And I’d love for you to teach me more about the companies that I already know.

Drop me a line if you have any questions / comments or just want to get in touch! yz@yishizuo.com

Disclaimer: I am not a registered investment advisor. Nothing I write should be construed as investment advice or the solicitation of investment.