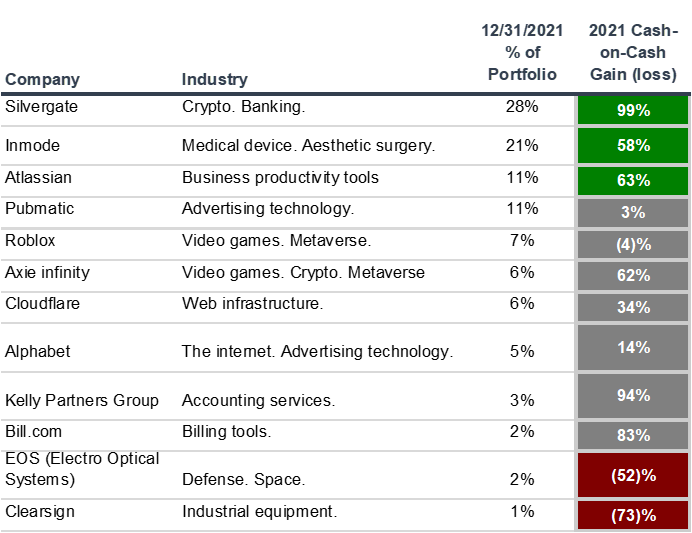

These “High growth beasts” comprise 38% of my portfolio as of 9/30/2020.

These 6 companies are growing rapidly and are priced at a premium. I believe that the strengths of these businesses justify their valuations, but decide for yourself.

Atlassian – NASDAQ: TEAM – (15% of portfolio as of 9/30)

Atlassian makes collaboration tools—primarily for software development.

Their flagship product—JIRA—is as important to software development as Microsoft Excel is to financial analysis.

Just like with Excel, users start with JIRA because it’s the industry standard. Once they become familiar, there are few reasons to switch.

Atlassian products are priced via a freemium SaaS model. It’s easy to get started, and costs scale naturally with the customer’s success. As such, relative to its fast-growing SaaS peers, Atlassian spends very little on sales and marketing.

Founded in 2002, the Australian-headquartered company raised very little capital until their 2016 IPO, and the two co-founders own a shade under 50% of the company today—a rarity amongst tech companies at this stage

Key risk(s):

The enterprise collaboration / productivity space is extremely crowded. While Atlassian does have tools beyond JIRA, they haven’t made much progress outside of its core developer market.

They tried to compete against Slack, but they called it quits in 2018 and instead transferred some IP and cash to Slack in return for an equity stake.

I wouldn’t be surprised if Atlassian bought Slack one day. After all, the 800-lb gorilla in the room is Microsoft, which is starting to encroach upon Atlassian’s core.

Can Atlassian ever expand beyond its core software developer market? That would be nice, but I don’t think it needs to.

Valuation:

You are paying $17 today for $1 of gross profit 3 years from now. (I assumed 25% annual growth)

(Most recent Atlassian investor deck)

InMode – NASDAQ: INMD – (8%)

InMode is an Israeli-headquartered medical device company that makes products used in non-invasive, aesthetic procedures.

My friend Jay Vasantharajah wrote this sharp, much more detailed analysis of InMode a few months ago—I suggest you read it!

Consumer demand for InMode’s products is growing rapidly, and they have a superior distribution + pricing model relative to its competitors.

Not only that, but relative to those players, InMode has better product, better marketing, and overall better management.

In recent years, InMode has grown much faster than its competitors, just this week management announced that Q3 revenue increased by ~100% from Q2 (which to be fair, was depressed by COVID).

Key risk(s):

There are many players in this space—some standalone, some owned by private equity, some owned by larger medical device companies.

Valuation:

You are paying $4 today for $1 of gross profit 3 years from now. (I assumed 60% annual growth)

(Most recent InMode earnings release)

Match Group – NASDAQ: MTCH – (8%)

Match Group is the dominant global player in online dating.

These products fulfill a core human need and are not going away. The market is far from saturated and monetization will continue go up.

Online dating is a tough business to enter. Users naturally leave the service, and customer acquisition costs relative to lifetime value is very high.

Fortunately for me as an investor, Match Group has first mover advantage, brand recognition and economies of scale. They have the ability to buy companies for cheap, cross-advertise across their properties, and monetize where others cannot.

Key risk(s):

Facebook announced in 2019 that it would enter this space. While Facebook certainly has the userbase, its attempts have so far to penetrate the dating space not made a dent.

Valuation:

You are paying $13 today for $1 of gross profit 3 years from now. (I assumed 10% annual growth)

(Most recent Match earnings release)

Duck Creek Technologies- NASDAQ: DCT – (2%)

Duck Creek is a US-based vertical software provider similar to Constellation and Enghouse; however, unlike those companies, Duck Creek only operates in one vertical—property & casualty insurance.

Byrne Hobart, who publishes a paid newsletter that I subscribe to, wrote a great feature on Duck Creek in August.

The company is in the middle of a transition to SaaS. Looking at the financials alone, Duck Creek’s 70%+ SaaS annual recurring revenue growth is obscured by its legacy business.

On the SaaS front, returning customers spent $1.13 for every dollar that customers spent last year – and this includes the negative impact of customers who left.

And according to management, Duck Creek wins 2/3 of all potential new business opportunities (including ones they are not asked to bid on).

Key risk(s):

Insurance isn’t going away, but you are exposed to one industry.

Valuation:

You are paying $7 today for $1 of gross profit 3 years from now. (I assumed 20% annual growth)

(No deck – but here is the Duck Creek IPO prospectus)

Bill.com- NYSE: BILL – (2%)

Bill.com is a SaaS platform that helps small-to-midsize businesses (SMBs) collect and pay their bills.

As a leader at a small company, I’ve personally used this product and am familiar with the value that it provides. Collecting and paying bills can be a pain in the butt

Interestingly, I see parallels between this product and Zoom 2-3 years ago—the same people who were early adopters of Zoom’s video conferencing software are the same people I see first to use Bill.com.

Returning Bill.com customers spent $1.21 for every dollar that customers spent last year – and this includes the negative impact of customers who left.

Bill.com’s opportunity extends beyond SMBs. The most agile, and ultimately successful, large enterprises will empower their smaller team to choose their own tools. The Bill.com’s of the world will penetrate large enterprises at the grass roots level and expand upward.

Key risk(s):

Valuation is very high.

Valuation:

You are paying $27 today for $1 of gross profit 3 years from now. (I assumed 40% annual growth)

(Most recent Bill.com investor deck)

Adyen – Euronext: ADYEN – (2%)

Adyen is a Netherlands-headquartered payments platform.

They enable “unified commerce”. In other words, they make it easy for their customers to accept payments in different countries in different formats.

Behind the scenes, the world of payments is incredibly complex and constantly evolving. And that is great for this company. When complex systems change so quickly, customers need tools like Adyen to adapt.

Because Adyen owns the merchant relationship, it doesn’t matter whether Visa, Mastercard, Unionpay, Apple Pay, Google Pay, Wechatpay, Alipay, Grabpay, or anyone else will prevail on the consumer side–ultimately, Ayden wins.

Key risk(s):

Valuation is very high.

Adyen competes with Square, which is US focused, and to a lesser-extent – Stripe, which is focused on digital businesses.

Adyen’s forte is multi-channel payments, and its core market is retailers with a physical presence.

Right now, there appears to be enough room for all these players to coexist

Valuation:

You are paying $48 today for $1 of gross profit 3 years from now. (I assumed 25% annual growth)

(Most recent Adyen investor day presentation)

Why I write about my portfolio

I want you to challenge my beliefs. I’d love for you to tell me what I’m missing. I want you to tell me about public companies that I may not know about. And I’d love for you to teach me more about the companies that I already know.

Next article: Silvergate – Hidden Network Effect in the Crypto Industry

Drop me a line if you have any questions / comments or just want to get in touch! yz@yishizuo.com

Disclaimer: I am not a registered investment advisor. Nothing I write should be construed as investment advice or the solicitation of investment.