Let’s talk investing. What’s the first thing that pops into your mind?

Stocks? Index funds? Real estate? Maybe some cryptocurrency / NFTs?

In any case, I’ll bet you’re thinking of a financial asset.

But let’s pause for a moment.

Investing is about much more than money. Financial capital is important, but it is only one of what I call “4 buckets of capital”:

- Financial capital

- Social capital

- Knowledge / experience capital

- Time capital

Let’s go through each bucket in a bit more detail.

Financial capital

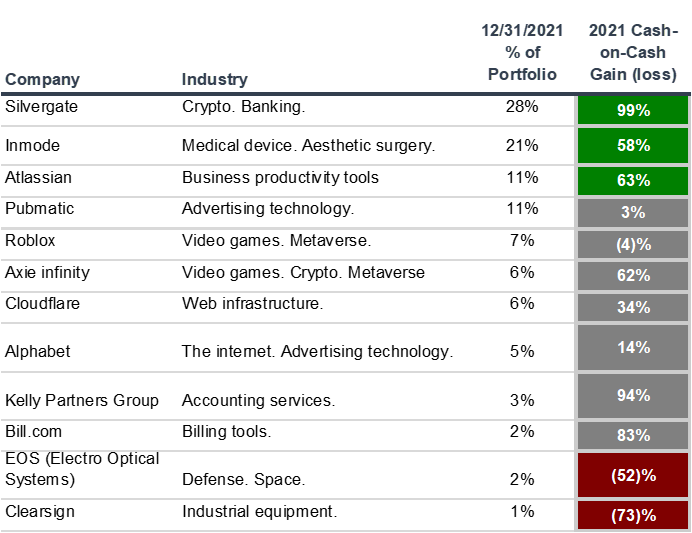

This bucket is straightforward. Generally, you make as much money as you can. You keep expenses as low as comfort allows. And with your savings, you buy assets that appreciate over time. (This is how I personally allocate 90%+ of my liquid net worth.)

But there is some nuance here. There are periods when you should forgo income and invest money and time in exchange for more knowledge, life experiences, and friendships.

For example, when you get an MBA or join an online learning community, you invest time and financial capital in return for social, knowledge, and experience capital.

Social capital

This bucket includes your friends, your family, and your reputation.

This is the size and strength of your network. This is your personal brand. It determines the engagement you have on social media. It determines who you can call on for help — for items big and small.

Social capital is determined by how and with whom you invest your time. And certainly, the size of your bank account has a significant impact too — and vice versa.

Social capital is driven not only by your looks, your personality, or your charisma, but it is also driven by your knowledge and experience.

For example, I write many articles like this — sharing my knowledge and experience in order to attract curious, like-minded individuals like yourself. For what purpose? I’m not exactly sure, but your reading this article increases my pool of social capital and enables both of us to accomplish things that we may not be able to do on our own 🙂

Knowledge / experience capital

I’ve combined knowledge and experience into one bucket, as I personally believe that the best learning comes from experience.

Knowledge can be translatable into other forms of capital, but that is not always the case.

For example, I’ve backpacked all over the world in my 20s. I have a lot of knowhow re: how to find a good hostel and get through hairy border crossings.

Do those experiences translate into financial capital? The answer is no. Social capital? That would also be a stretch.

But that’s ok. Travelling has led to many fond memories. After all, the goal of investing is to maximize long-term happiness.

Time capital

This is the most precious bucket of all, and the most finite. We have but one life to live.

Each of the other buckets of capital requires time to accumulate. You need to invest time to do your job, research a stock, build a relationship, learn a skill, or travel the world.

There are far too many options in life, we have to narrow our focus and choose our time investment wisely.

Conclusion

Each of the 4 buckets of capital is intricately linked.

Think for a moment: “What’s in your bucket? What are your strengths?”

Much of mainstream investment advice is focused on accumulating financial capital, and little else.

Few professional investors or financial advisors actively discuss what I think is the most important end goal of all—maximizing our long-term happiness. Happiness requires more than just money. And the other buckets do not get as much attention as they deserve.

This is part 1 of my First Principles of Investing – the core of how I think and how I try to help others in my community.

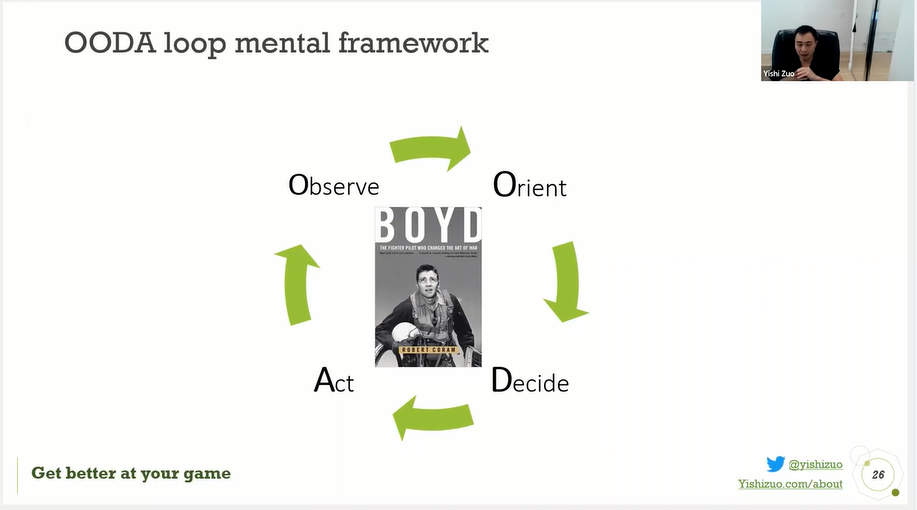

Part 2: Choose the game you play