Hi, I’m

Yishi Zuo

I build companies.

I learn and play.

I write.

I build companies.

I learn and play.

I write.

I build companies.

I learn and play.

I write.

I build companies.

I learn and play.

I write.

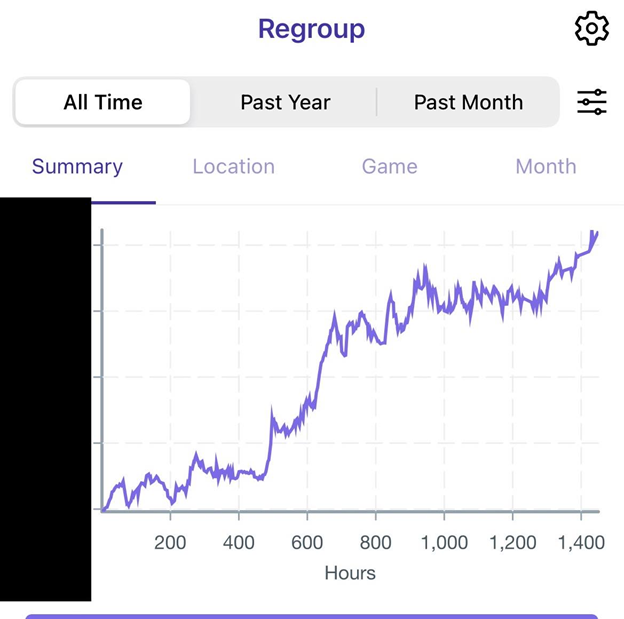

My personal journey, Poker

When I first started playing poker regularly in 2019, I was looking for fun. I wanted a new hobby to get good at – with the bonus hope of making...

My personal journey

What’s the most embarrassing thing that has ever happened to you during an interview? For me, it was breaking down uncontrollably in tears. No, it wasn’t a tough question that...

My personal journey, Poker

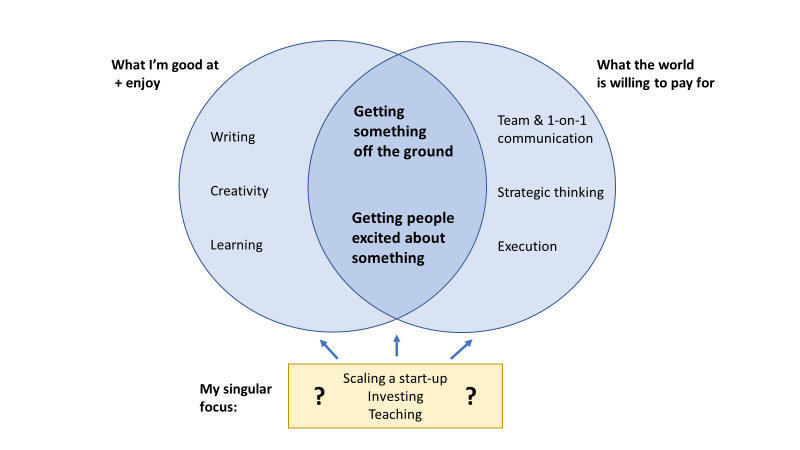

I write to explore my own thoughts. It’s a creative outlet. Some of my most enjoyable-to-write articles were about niche, eclectic topics that have received very few clicks: While I’m...

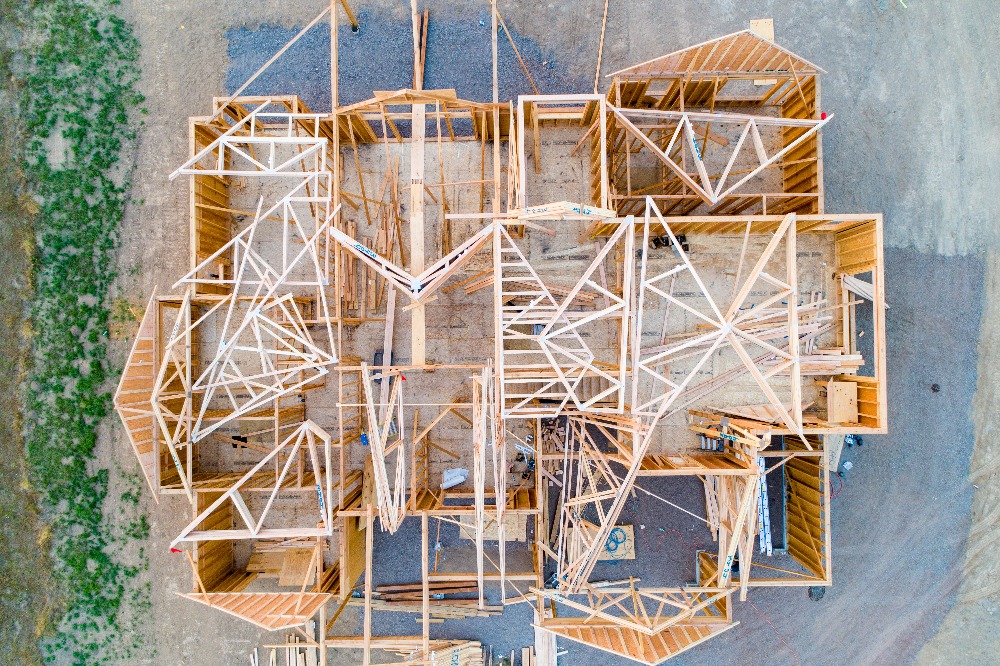

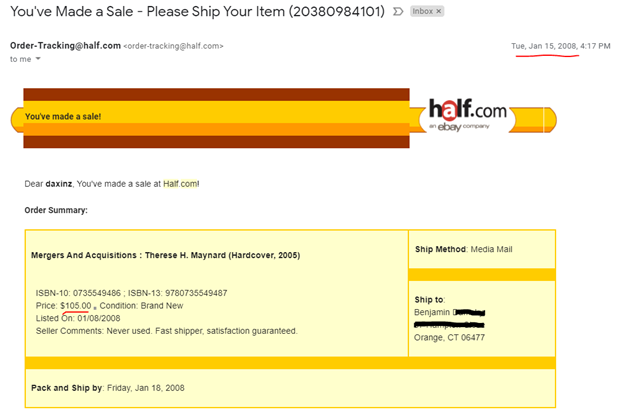

My personal journey

My first entrepreneurial experience happened right after my first semester of college. In January 2008, I did a brief winter internship. My boss was a part time law professor. Publishers...

Self-growth principles, My personal journey

Once upon a time at a dinner party, Bill Gates and Warren Buffett were asked to write on a napkin, the single most important driver of their success. They thought...

My personal journey

Earlier in my life, I struggled with self-awareness and setting boundaries. Let’s travel back in time to my freshman year of college—fall 2007. I had a very memorable roommate. We...

My personal journey

Earlier this week, I bought a brand-new car for the first time. I used tricks that I’ve learned as an entrepreneur, and the negotiation was rather fun. Join me for...

Business Analysis

Can tigers be a sustainable business model? Maybe. Viewed from conventional business lens, tigers are an awful asset class. The fundamental problem: timing of cash flows In any business, you...

History

Have you ever wondered what evil looks like up close? Or, have you considered what it would be like to be trapped in close quarters, for months on-end with a...

Policy & politics

My parents brought me to America when I was 6 years old. Not a day goes by do I forget how fortunate I am to be a naturalized US citizen....

Business Analysis

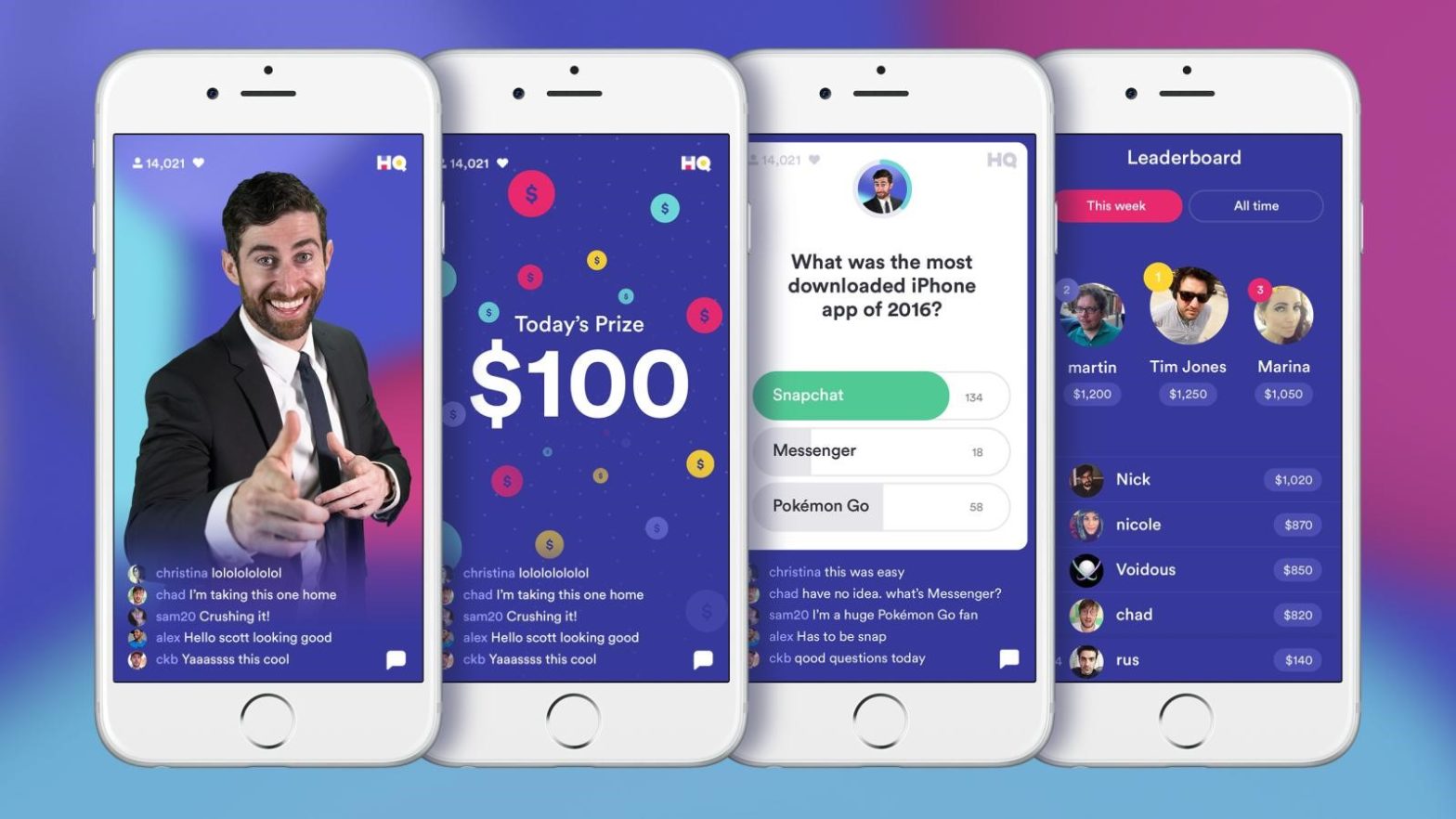

Take a look at the economics of a lottery, and you’ll realize that these things are extremely profitable. From the Roman Empire to the Han Dynasty, governments have long recognized...

Business Analysis

GameStop can become the physical gateway to various virtual worlds. And this is a TRILLION-dollar opportunity. As insane as the GameStop story has been, I think there could be long-term...