*Writings are displayed in reverse-chronological order*

My personal journey, Poker

My evolving relationship with poker

When I first started playing poker regularly in 2019, I was looking for fun. I wanted a new hobby to get good at – with the bonus hope of making

My personal journey

My most embarrassing interview experience

What’s the most embarrassing thing that has ever happened to you during an interview? For me, it was breaking down uncontrollably in tears. No, it wasn’t a tough question that

My personal journey, Poker

What writing does for me (and perhaps you as well)

I write to explore my own thoughts. It’s a creative outlet. Some of my most enjoyable-to-write articles were about niche, eclectic topics that have received very few clicks: While I’m

My personal journey, Investing

Run-in with a con man

A while back, I met an entrepreneur. Let’s call him Gary (not his real name). I took a liking to Gary, and I took a small amount of funds from

Policy & politics

Crypto, gambling, drugs, and free speech

Last month, I spent a great deal of time exploring “tokenomics” for a start-up in the crypto space. Tokenomics is a fancy word for incentive design. It’s a way for

My personal journey

What’s the best moment of your life?

Have you ever asked yourself that before? It’s a powerful self-reflection exercise. In figuring out what makes a moment great for you, you learn a lot about yourself—your core values,

My personal journey

What is coaching and why I got into it

Coaching has been an integral part of my personal growth over the past few years. It took me a while to figure out boundary-setting and self-awareness in my early 20s.

My personal journey

Business school gossip & start-up learnings

What do you really learn in business school? I went to business school in 2016 in large part because I wanted to improve my emotional intelligence. Almost right away, I

Investing

Yishi’s stock portfolio 2021 review & reflections

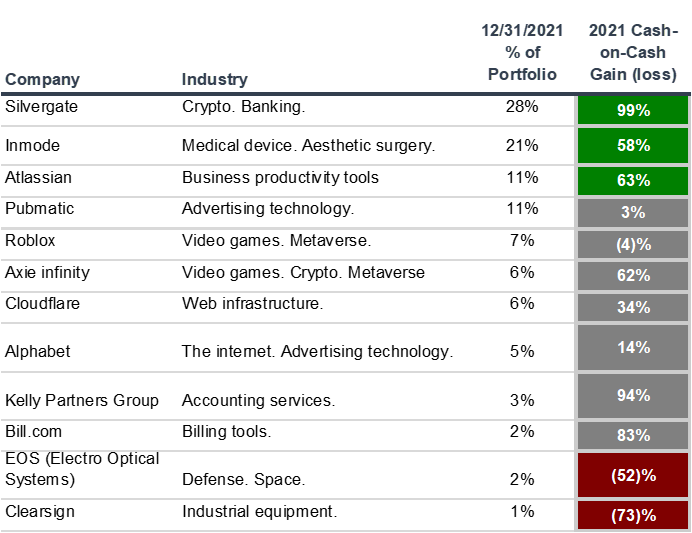

My portfolio returned 53% in 2021, vs. 29% for the S&P. Here is a closer look: Disclaimer: I am not a registered investment advisor. Nothing I write should be construed

My personal journey

The art of non-violent confrontation

Earlier in my life, I struggled with self-awareness and setting boundaries. Let’s travel back in time to my freshman year of college—fall 2007. I had a very memorable roommate. We

Self-growth principles, Investing

OODA loop – practical lessons from a military genius

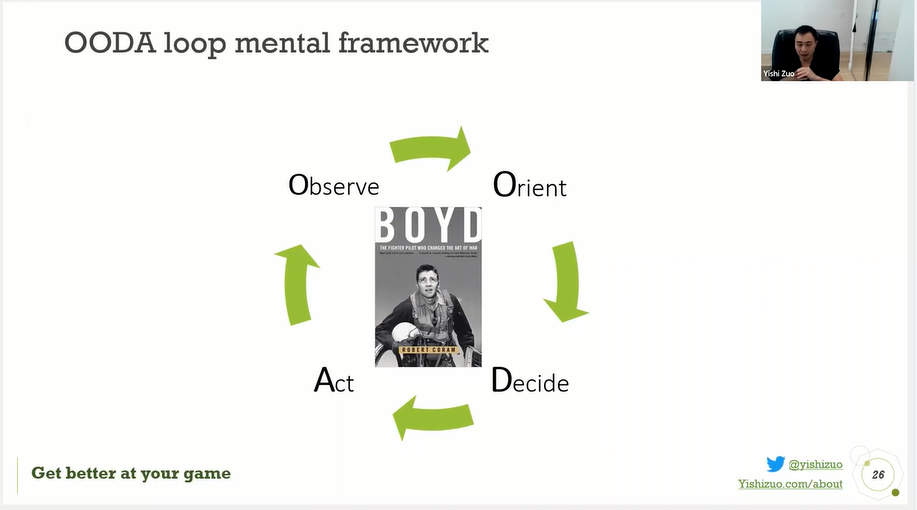

John Boyd was arguably the most brilliant military strategist since Genghis Khan. However, few have heard of him. Boyd was an iconoclast who revolutionized modern warfare, and his biography is

Self-growth principles, Investing

Choose the game you play

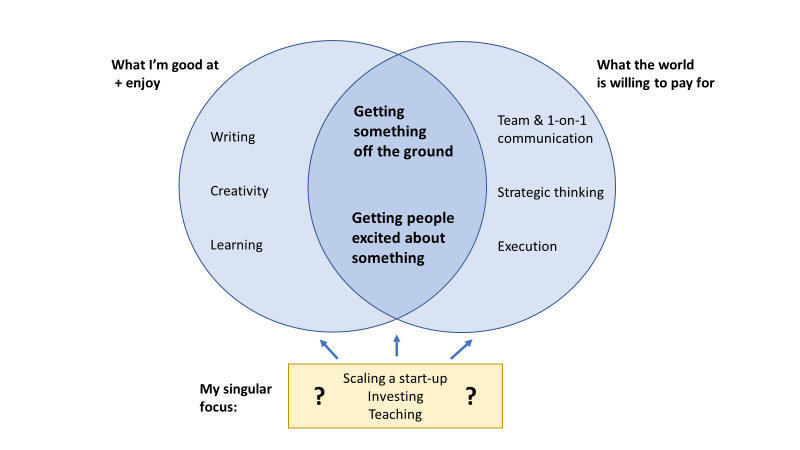

Let’s suppose that your goal in life is to maximize your long-term happiness. What should you do? Last time we talked about your 4 buckets of capital: financial, social, knowledge

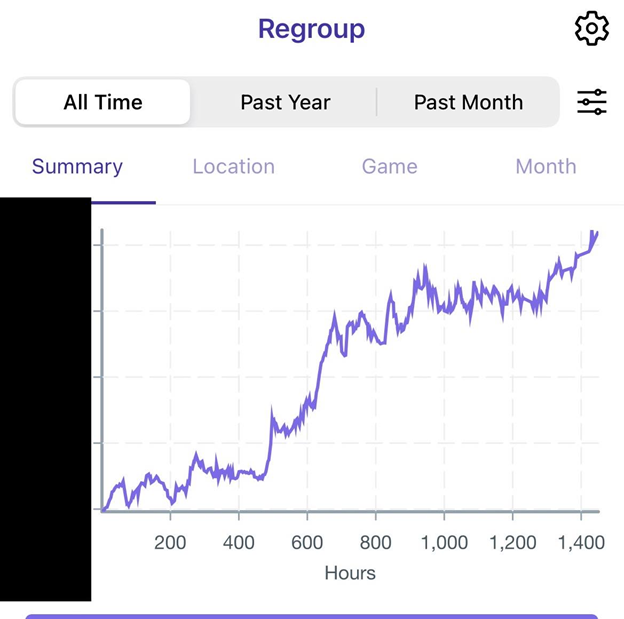

My personal journey, Poker

My evolving relationship with poker

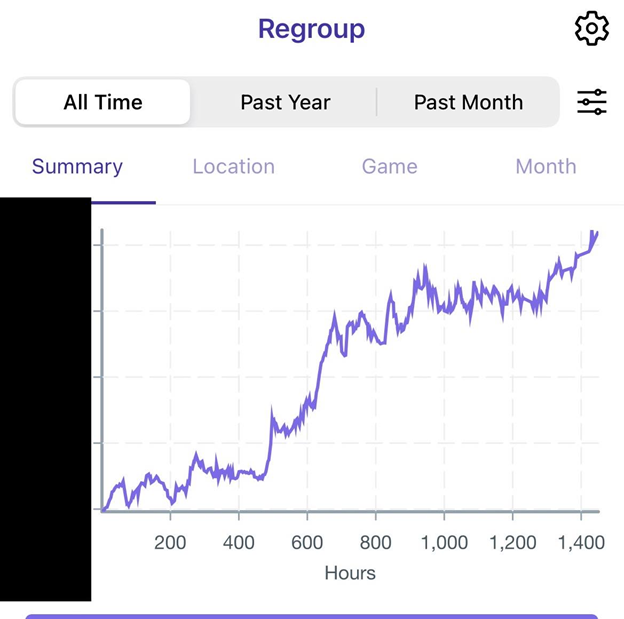

When I first started playing poker regularly in 2019, I was looking for fun. I wanted a new hobby to get good at – with the bonus hope of making a few bucks on the side. Since then, my relationship with the game has evolved. After 1,400+ hours of poker over the past 4 years. …

My personal journey

My most embarrassing interview experience

What’s the most embarrassing thing that has ever happened to you during an interview? For me, it was breaking down uncontrollably in tears. No, it wasn’t a tough question that stumped me. And it wasn’t the interviewer being an ass. I was the interviewer. I felt like the ass. Here is the story of what …

Continue reading "My most embarrassing interview experience"

My personal journey, Poker

What writing does for me (and perhaps you as well)

I write to explore my own thoughts. It’s a creative outlet. Some of my most enjoyable-to-write articles were about niche, eclectic topics that have received very few clicks: While I’m happy to write whatever catches my fancy, I also care about maximizing my long-term impact. How should we measure the impact of our writing? Good …

Continue reading "What writing does for me (and perhaps you as well)"

My personal journey, Investing

Run-in with a con man

A while back, I met an entrepreneur. Let’s call him Gary (not his real name). I took a liking to Gary, and I took a small amount of funds from my “highly speculative” bucket and put it into his project. The amount was nothing to lose sleep over. From the beginning, I thought of this …

Policy & politics

Crypto, gambling, drugs, and free speech

Last month, I spent a great deal of time exploring “tokenomics” for a start-up in the crypto space. Tokenomics is a fancy word for incentive design. It’s a way for you to jumpstart a business by giving certain groups of people “tokens” in exchange for using your product or promoting it. The idea is that: …

My personal journey

What’s the best moment of your life?

Have you ever asked yourself that before? It’s a powerful self-reflection exercise. In figuring out what makes a moment great for you, you learn a lot about yourself—your core values, and what drives you. A couple of months ago, I did a “Zone of Genius” exercise with Brandon Lee – where I revisited eight of …

My personal journey

What is coaching and why I got into it

Coaching has been an integral part of my personal growth over the past few years. It took me a while to figure out boundary-setting and self-awareness in my early 20s. In my mid-to-late 20s, business-school and entrepreneurship helped increase my emotional maturity. Now let me explain how I got into coaching, and how it can …

My personal journey

Business school gossip & start-up learnings

What do you really learn in business school? I went to business school in 2016 in large part because I wanted to improve my emotional intelligence. Almost right away, I had a formative experience. Learning via peers A month into my first semester, I was working on a group project. One of our tasks was …

Continue reading "Business school gossip & start-up learnings"

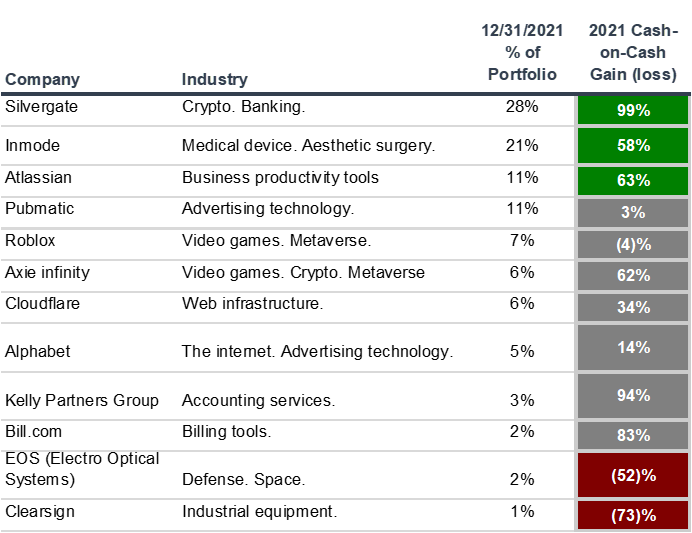

Investing

Yishi’s stock portfolio 2021 review & reflections

My portfolio returned 53% in 2021, vs. 29% for the S&P. Here is a closer look: Disclaimer: I am not a registered investment advisor. Nothing I write should be construed as investment advice or the solicitation of investment. This is for educational and entertainment purposes only. Notable winners: Overall, my biggest positions performed well. Silvergate …

Continue reading "Yishi’s stock portfolio 2021 review & reflections"

My personal journey

The art of non-violent confrontation

Earlier in my life, I struggled with self-awareness and setting boundaries. Let’s travel back in time to my freshman year of college—fall 2007. I had a very memorable roommate. We can call him Joe. One night, Joe hosted a party in our dorm. He was caught with alcohol, and I took the blame. Why did …

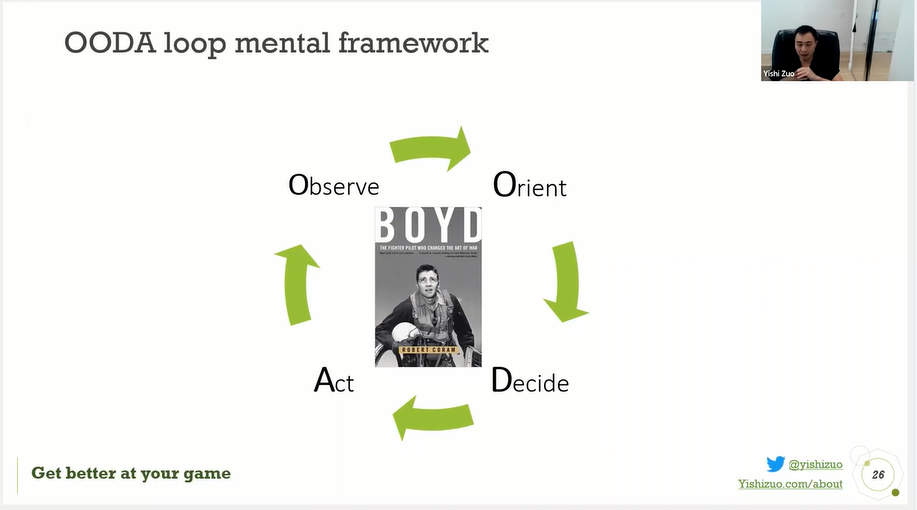

Self-growth principles, Investing

OODA loop – practical lessons from a military genius

John Boyd was arguably the most brilliant military strategist since Genghis Khan. However, few have heard of him. Boyd was an iconoclast who revolutionized modern warfare, and his biography is one of my all-time favorite books. John Boyd was not just a theoretician; he was a practitioner. When practitioners use their personal experience to teach, …

Continue reading "OODA loop – practical lessons from a military genius"

Self-growth principles, Investing

Choose the game you play

Let’s suppose that your goal in life is to maximize your long-term happiness. What should you do? Last time we talked about your 4 buckets of capital: financial, social, knowledge / experience, and time. This article is about: How to figure out what you have and don’t have How to increase what you want, and …

Self-growth principles, Investing

4 buckets of capital

Let’s talk investing. What’s the first thing that pops into your mind? Stocks? Index funds? Real estate? Maybe some cryptocurrency / NFTs? In any case, I’ll bet you’re thinking of a financial asset. But let’s pause for a moment. Investing is about much more than money. Financial capital is important, but it is only one …

Self-growth principles, My personal journey

Always happy, never satisfied

Once upon a time at a dinner party, Bill Gates and Warren Buffett were asked to write on a napkin, the single most important driver of their success. They thought for a moment, wrote their answers separately, and revealed their response simultaneously. “Focus” was the word on both napkins. Fantastic. The secret is out. Time …

My personal journey

New career announcement! Finding structure through serendipity (Part 3)

Exciting announcement: I will teach a First Principles of Investing course for On Deck Investing (ODI) and coach ambitious, entrepreneurial learners 1-on-1 this fall! This is the tale of how everything serendipitously came together and where I plan to go from here. To begin, you should know that I spend a lot of time writing. …

Continue reading "New career announcement! Finding structure through serendipity (Part 3)"

My personal journey

Entrepreneurial reflections via exploration (Part 2)

Continued from part 1: Learning to explore I’ve now had plenty of time to reflect on my last start-up, which continues to grow and has reached profitability! There were some good decisions and some lucky breaks along the way. However, as a first-time founder, I made too many mistakes to count. I’d like to highlight …

Continue reading "Entrepreneurial reflections via exploration (Part 2)"

Self-growth principles, My personal journey

Learning to explore (Part 1)

A little over a year ago, I sold every piece of furniture I owned in Boston, I packed what remained of my belongings into a rented Chevy Malibu, and I drove west. For nearly 4 years, I had been the CEO of a start-up that I co-founded during business school. The company had grown to …

History

Psychopath on the Batavia — the most incredible yet true story you’ve never heard before

Have you ever wondered what evil looks like up close? Or, have you considered what it would be like to be trapped in close quarters, for months on-end with a psychopath? Well, all you have to do is read on to find out. It’s the year 1628. Batavia is the brand-new flagship of the Royal …

My personal journey

Negotiating from a position of weakness: a step-by-step guide

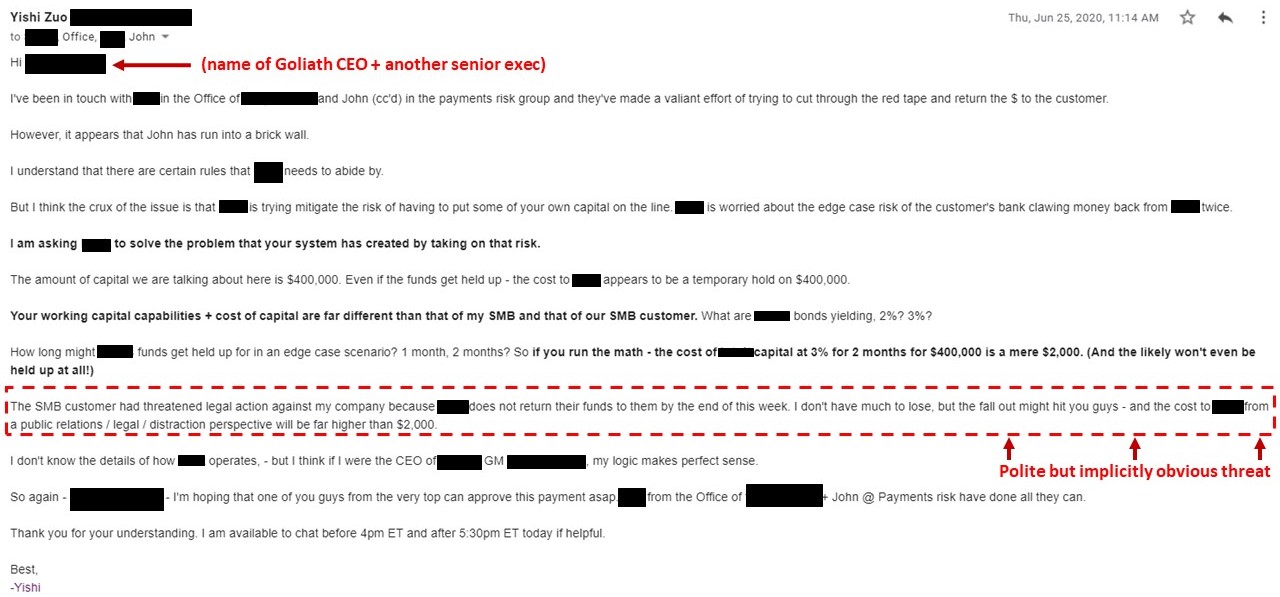

In my last article, I mentioned that a large company once held $400,000 of our money hostage. Here is a step-by-step replay of what actually happened and practical lessons learned. If you like underdog stories, then you’ve come to the right place. The context A customer sends us $400,000, and for several days, the money …

Continue reading "Negotiating from a position of weakness: a step-by-step guide"

Self-growth principles

Be YOUR hammer and look for YOUR nail

One of my worst moments as a start-up CEO was when I lost $400,000. The short of it is that a customer had sent us the money, but my company was too small to receive such a large payment. And due to technical reasons, our payment processor could not refund him. In a kafkaesque twist, …

Self-growth principles, Investing

Don’t be a hammer looking for a nail

Has there ever been a more spectacular start-up failure than Quibi in 2020? $1.4 billion down the drain. Total shutdown merely 6 months after launch. Quibi built a product without understanding the customer’s needs. It’s a common start-up mistake–one that I’ve made myself. This mistake comes with a catchphrase: “Solution looking for a problem”. It’s …

Business Analysis

GameStop’s Moral Mandate – Go Big or Go Home

GameStop can become the physical gateway to various virtual worlds. And this is a TRILLION-dollar opportunity. As insane as the GameStop story has been, I think there could be long-term value here. This is my strategic vision for unlocking that long-term value, written as if I were on the management team. Choose the right battle …

Continue reading "GameStop’s Moral Mandate – Go Big or Go Home"

Self-growth principles, My personal journey, Investing

My worst investment mistake and 3 lessons learned

I stared at the screen in disbelief. My biggest stock position was down 90%. $30,000 of my hard-earned savings down the drain. Permanently. How the HELL did this happen? At the time, I was a professional investment analyst. I thought I knew what I was doing. But I made a colossal mistake and lost a …

Continue reading "My worst investment mistake and 3 lessons learned"

Investing

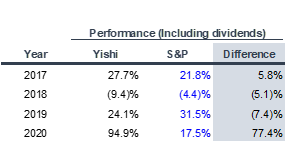

My 2020 stock portfolio performance and 3 lessons learned

**Update January 2021** – 2021 results have been published. I left my full-time hedge fund job in May 2016. Subsequently, 2017 was my first full year of investing without constraints, and here are my results: While 2020 turned out well—2017, 2018, and 2019 were mediocre—when I underperformed the market on average. Extreme pessimism & extreme …

Continue reading "My 2020 stock portfolio performance and 3 lessons learned"

My personal journey

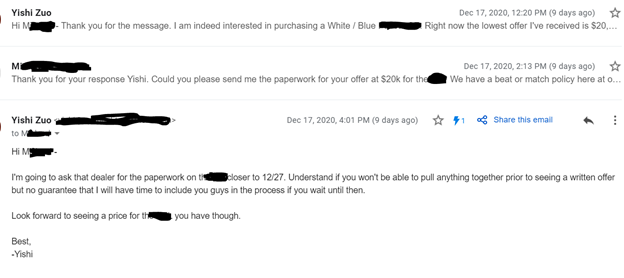

Negotiating a new car purchase – a step-by-step guide

Earlier this week, I bought a brand-new car for the first time. I used tricks that I’ve learned as an entrepreneur, and the negotiation was rather fun. Join me for a step-by-step replay of how it went down. Step #1: Do research beforehand Weeks in advance, we decide the exact make and model we want. …

Continue reading "Negotiating a new car purchase – a step-by-step guide"

My personal journey

The privilege to take a risk

My first entrepreneurial experience happened right after my first semester of college. In January 2008, I did a brief winter internship. My boss was a part time law professor. Publishers would regularly send him sample textbooks—with the hope that he would select one of their textbooks for his class. The idea is that students would …

Investing, Business Analysis

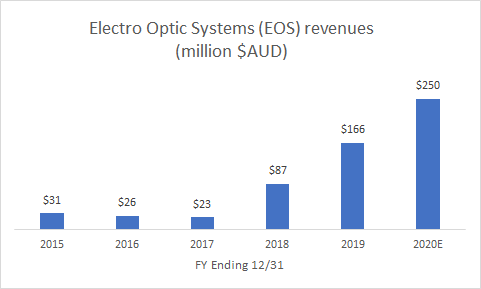

Electro Optic Systems (EOS) – a unique defense company

Years ago, when I worked as a hedge fund analyst, I dove deep into the satellite + space imaging industry. The most interesting thing I learned was that space debris is a huge problem for humanity. This scene from the movie Gravity demonstrates the problem pretty well. Orbiting space debris travel 7x faster than bullets. …

Continue reading "Electro Optic Systems (EOS) – a unique defense company"

Investing, Business Analysis

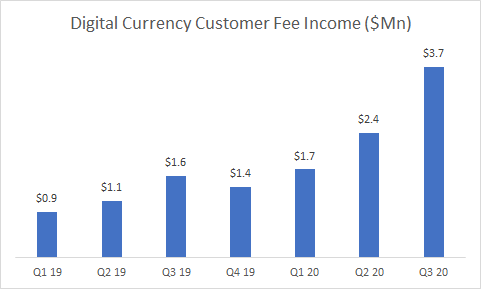

Silvergate – Hidden Network Effect in the Crypto Industry

I have a decent grasp of the technology and utility of blockchains. I think that digital currencies add value to our world. And I think they will be here to stay. If you can feel comfortable that the entire blockchain ecosystem isn’t a scam—a BIG IF given that Warren Buffett is convinced that Bitcoin is …

Continue reading "Silvergate – Hidden Network Effect in the Crypto Industry"

Investing

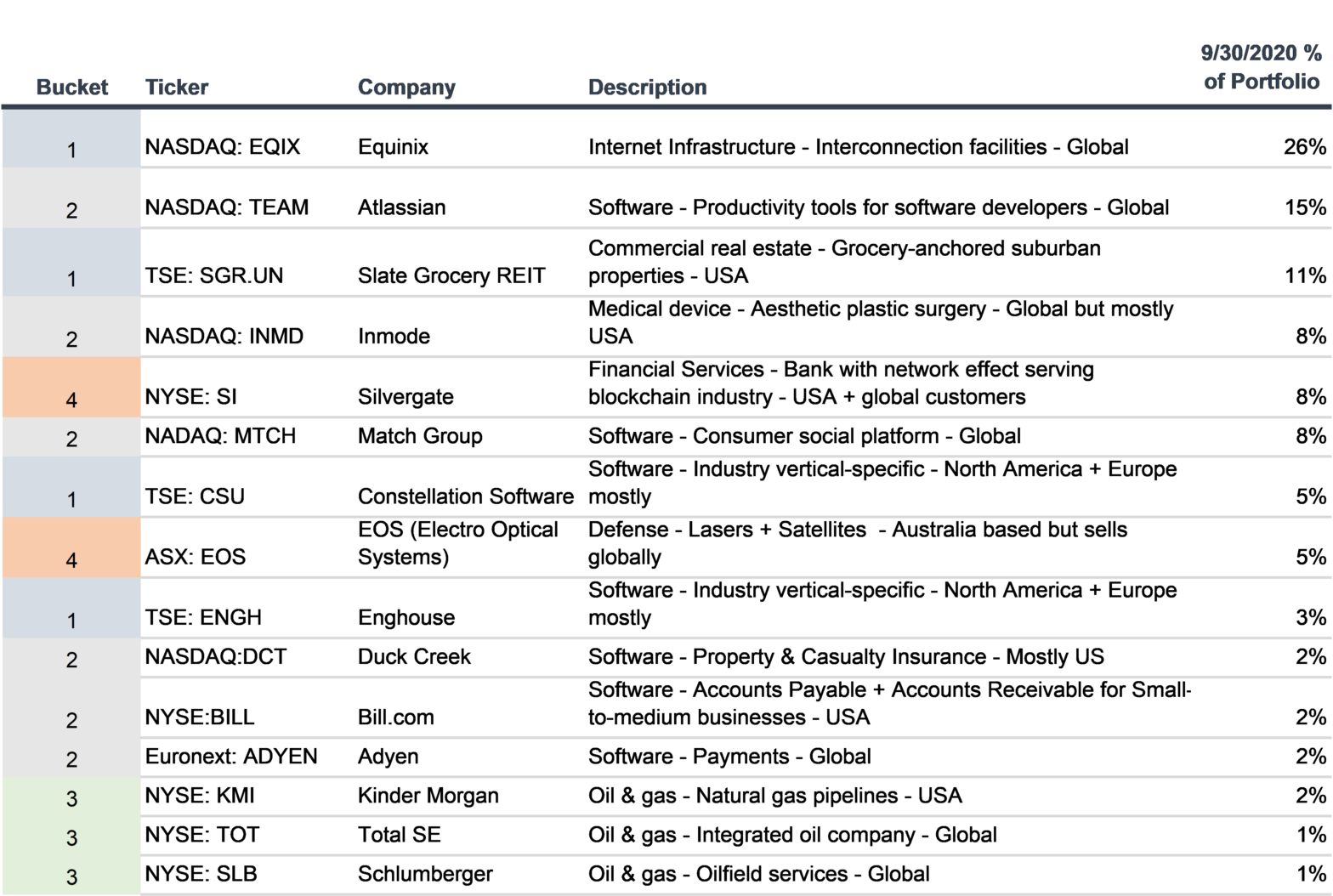

Stock Bucket #2 – High Growth Beasts

These “High growth beasts” comprise 38% of my portfolio as of 9/30/2020. These 6 companies are growing rapidly and are priced at a premium. I believe that the strengths of these businesses justify their valuations, but decide for yourself. Atlassian – NASDAQ: TEAM – (15% of portfolio as of 9/30) Atlassian makes collaboration tools—primarily for …

Investing

Yishi’s Stock Bucket #1 – Stable Cash Generators

These “stable cash generators” comprise 47% of my portfolio as of 9/30/2020. These 4 companies aren’t growing particularly fast, but I like the risk-reward trade-off. It is unlikely that any will double in 6 months. But the chance of permanent loss of capital is low. In a downturn, these businesses should do fine. Equinix – …

Continue reading "Yishi’s Stock Bucket #1 – Stable Cash Generators"

Investing

Yishi’s Stock Portfolio Q3 2020 Review

Here is an overview of my personal stock portfolio as of September 30th, 2020. The 15 companies I own span a wide variety of industries. US centric with global revenues: Most of my portfolio companies are headquartered in the US. The rest are all based in Western countries. However, much of the collective revenue is …

Business Analysis

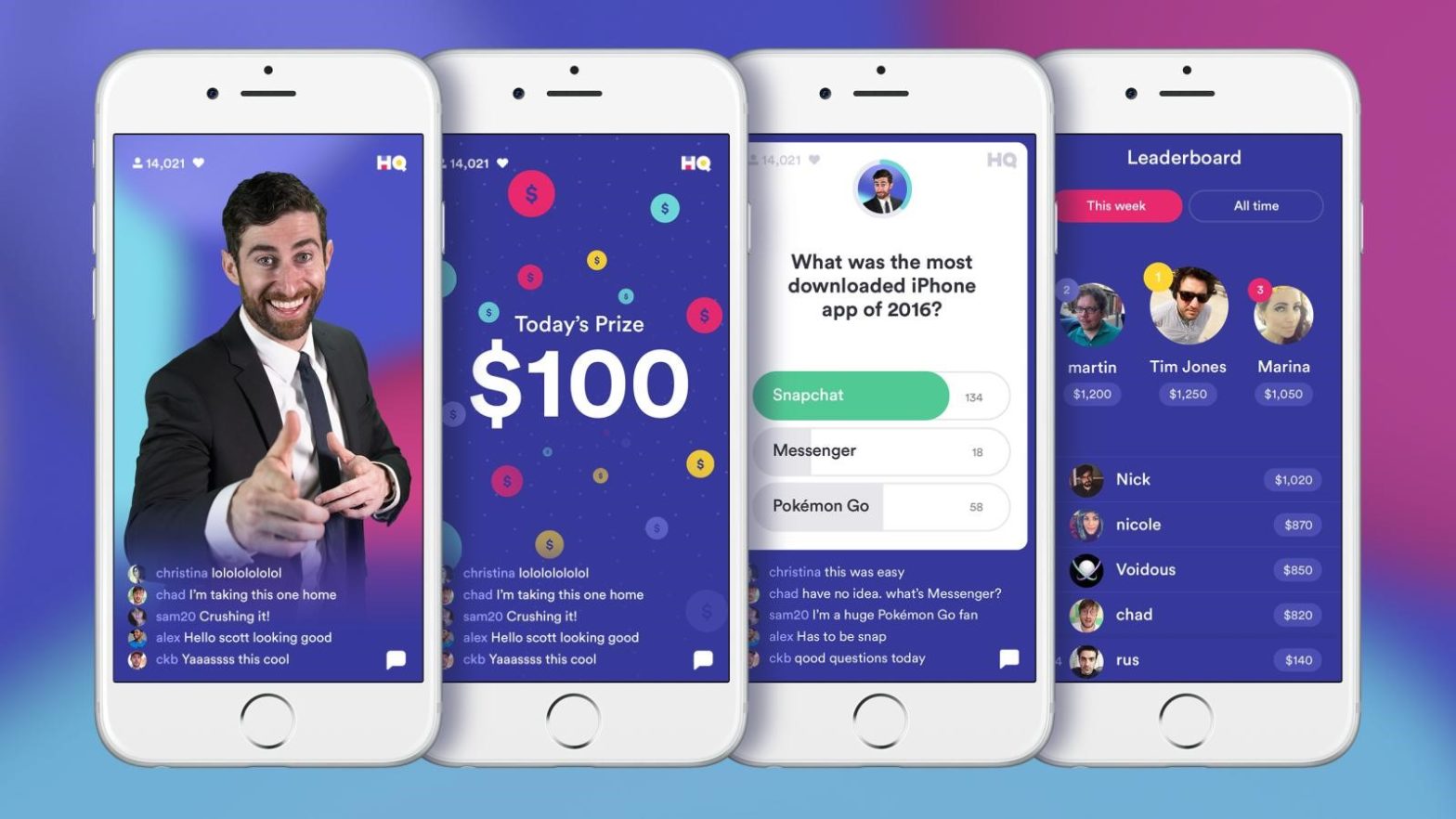

Hidden in plain sight – how corporations exploit the power of lotteries

Take a look at the economics of a lottery, and you’ll realize that these things are extremely profitable. From the Roman Empire to the Han Dynasty, governments have long recognized that lotteries are a license to print money. And of course, even the dumbest emperor would not allow this type of power to go unchecked. …

Continue reading "Hidden in plain sight – how corporations exploit the power of lotteries"

Business Analysis

How YOU can become a millionaire Tiger King

Can tigers be a sustainable business model? Maybe. Viewed from conventional business lens, tigers are an awful asset class. The fundamental problem: timing of cash flows In any business, you want to match the duration of your assets and liabilities. More simply, you want your bills to be due at the same time cash flow …

Continue reading "How YOU can become a millionaire Tiger King"

Business Analysis

Business Opportunities in Chess: Pay-to-play Micropayments

I’m a casual Chess player. I once took classes as an 8-year old. I remember playing a decent amount on Yahoo! Games as a teenager. But mainly, it was the in-person, banter-filled games with my best friends in high school that I loved most. One thing that I’ve always liked about Chess is how universal …

Continue reading "Business Opportunities in Chess: Pay-to-play Micropayments"

Business Analysis

Knowledge as an addictive drug — an investor’s guide to the expert network industry

In 1995 Jeff Bezos could have started Amazon by selling any product, but he chose to sell books for two reasons: 1) high number of SKUs and 2) low storage costs. Question: What has infinite SKUs, and zero storage costs? Answer: Expert knowledge. A modified version of this article first appeared in Integrity Research. What are …

Policy & politics

“We win, they lose” – Radically Reframing the US Immigration Debate

My parents brought me to America when I was 6 years old. Not a day goes by do I forget how fortunate I am to be a naturalized US citizen. Now, as a tech entrepreneur who has created American jobs, I’ve witnessed the absurdity of the American immigration system up close. Immigration is a topic …

Continue reading "“We win, they lose” – Radically Reframing the US Immigration Debate"

Self-growth principles, Poker

Poker + business + applied lessons from Nassim Taleb

This summer, a casino opened up right by Boston. And I’ve swung by a few times to play Texas Hold’em — low stakes cash games. As mentioned in my Liar’s Dice article, I love games that involve incomplete information, strategic deception, and reading people. Pokers offers an exciting challenge that complements my career. As a start-up …

Continue reading "Poker + business + applied lessons from Nassim Taleb"

Business Analysis

Jack the Driver + The Bali Private Transportation Market

I recently visited Bali and had pre-arranged for a driver to take me from the airport to my hotel. This was a 2 hour trip, and I used the opportunity to get to know my driver Jack and his line of work. Jack comes from a family of drivers. He has 3 brothers – all …

Continue reading "Jack the Driver + The Bali Private Transportation Market"

Business Analysis

The Mystery of Mom’s Medicine

A few weeks ago, my mom and I were chatting on the phone when she brought up something perplexing. The backstory A few months ago, my mom goes to her doctor for a routine appointment. Her doctor prescribes medication, and she goes to a nearby pharmacy – Walmart –to get the prescription filled At Walmart, …

Business Analysis

Unlocking Serendipity at Conferences & Events

Last month, I attended a 3-day conference focused on education & the future of work. There were 3,000+ attendees – and I barely knew any of them. So of course, I did my homework. I spent hours browsing through hundreds of individual profiles, thought carefully about who might be interested in what I’m doing, read …

Continue reading "Unlocking Serendipity at Conferences & Events"

Business Analysis

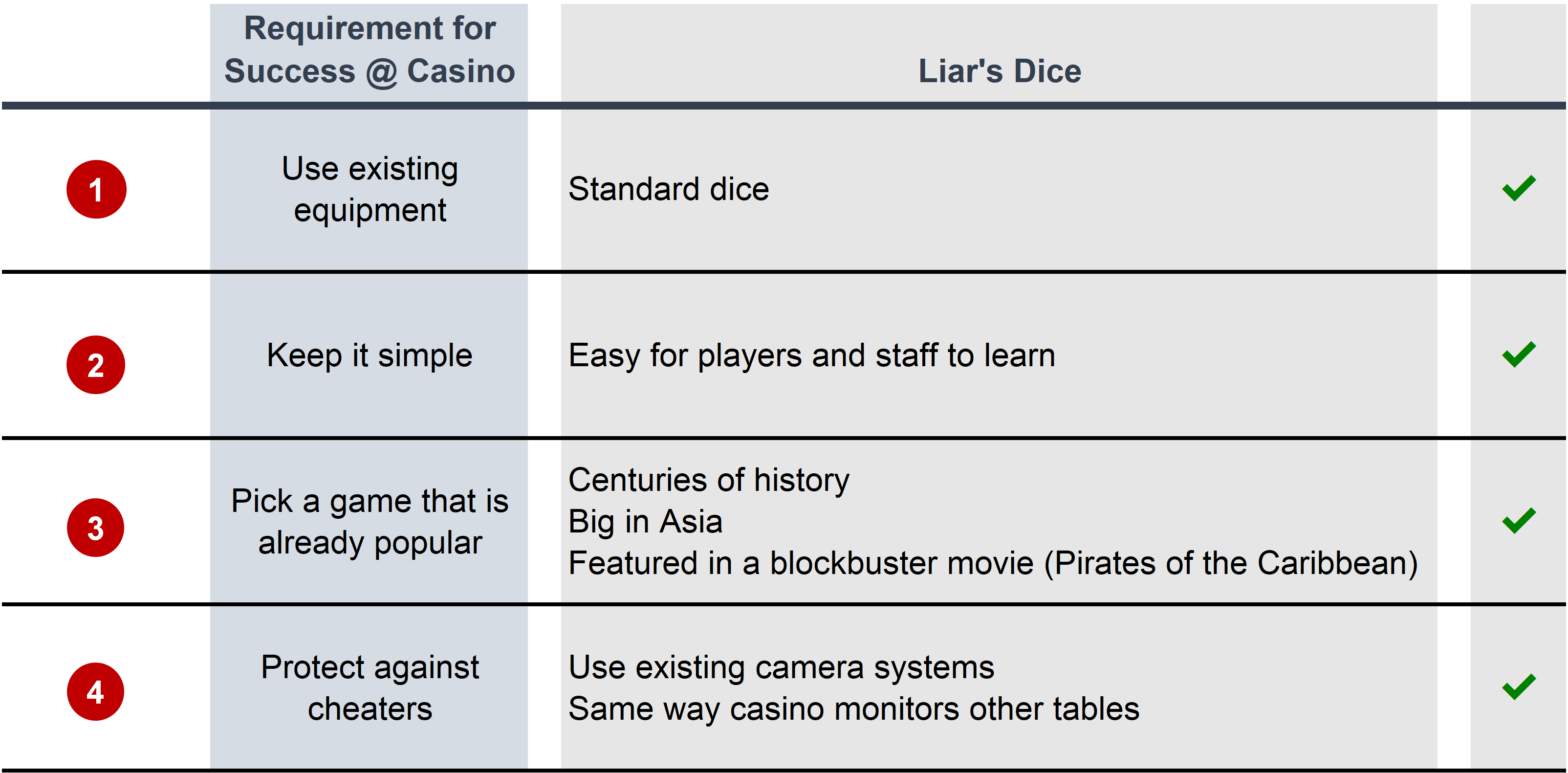

IDEA: Turning Liar’s Dice into the next Texas Hold’em

Liar’s Dice is one of the best games ever invented. It is a fast-paced game involving luck, probability & bluffing. It is easy to learn – you don’t need to be particularly good at math. If you can divide 24 by 3 in your head, you will do just fine. And most 12-year-old kids should …

Continue reading "IDEA: Turning Liar’s Dice into the next Texas Hold’em"

Business Analysis

IDEA: Twitter meets Slack / WhatsApp

Problem & Vision Twitter starts with public conversations and moves inward via threaded replies & direct messages. What if there was a platform that starts the other way around—by focusing on private conversations with friends, with the ability to expand outward to include strangers? I read Twitter regularly to keep up to date and broaden …

My personal journey

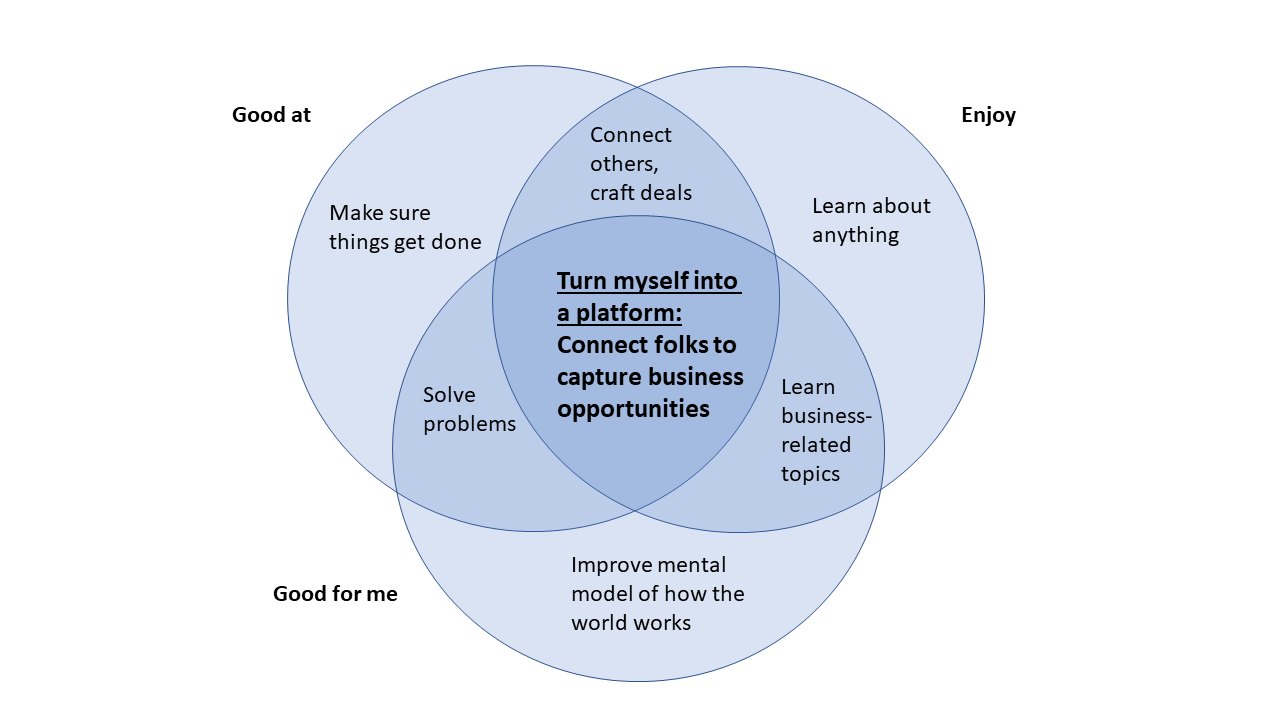

My Personal Mission & How I Arrived Here (Part 3 of 3)

(Note, this is Part 3 of a 3 Part Series titled “My Personal Why”. Part 1 – Switching from Hedge Fund Investor to Software Entrepreneur, Part 2 – Warren Buffett, Charlie Munger, and the Principles of Entrepreneurship) An interesting shaving story A little over a year ago, I was in Las Vegas with a few business …

Continue reading "My Personal Mission & How I Arrived Here (Part 3 of 3)"

Self-growth principles, Investing

Warren Buffett, Charlie Munger, and the Principles of Entrepreneurship

Over the years, I’ve invested hundreds of hours in trying to absorb the worldly wisdom of Warren Buffett & Charlie Munger. (Saved here are the best Munger / Buffett materials that I have come across– please feel free to read, learn and share!) The core tenets of Buffett and Munger have profoundly shaped the way …

Continue reading "Warren Buffett, Charlie Munger, and the Principles of Entrepreneurship"

Self-growth principles, My personal journey

My Personal Why – Switching from Hedge Fund Investor to Software Entrepreneur (Part 1 of 3)

(Note, Part 2 has been published: “Warren Buffett, Charlie Munger, and the Principles of Entrepreneurship“) I enjoyed my last job as a hedge fund investor. I found the work highly intellectually stimulating. Being an investor aligned well with my lifelong desire to better understand how our world works But I felt like something was missing. …

Self-growth principles, Interviews

Business Tips from David Cohen – Founder & CEO of Techstars

Backstory 3 years ago, I co-founded a start-up around the concept of lease-to-own domain names. David Cohen, the co-founder of Techstars, was one of our first customers. To our chagrin . . . he was also one of our only customers! Needless to say, that business never took off, but one great thing that emerged …

Continue reading "Business Tips from David Cohen – Founder & CEO of Techstars"

Business Analysis

Counterintuitive Takeaways from an MIT Nobel Laureate’s Research

Does more information in a market = a better functioning market? Sounds true – but not always, according to the latest work from MIT Nobel Laureate Bengt Holmström. After reviewing this blog post, Professor Holstrom had the following comments: I want to avoid the (commonly) mistaken impression that I’m saying financial market liquidity doesn’t require …

Continue reading "Counterintuitive Takeaways from an MIT Nobel Laureate’s Research"

Self-growth principles, Interviews

3 Takeaways from Alfred Chuang – Former CEO of BEA Systems

Originally from Hong Kong, Alfred Chuang came to North America for higher education. After graduating in the 1980s, he joined Sun Microsystems and rose through the ranks. In 1995, Alfred left Sun to co-found BEA Systems as the CTO. He became CEO in 2001, and Chairman of the Board in 2002. Eventually BEA Systems was …

Continue reading "3 Takeaways from Alfred Chuang – Former CEO of BEA Systems"

Business Analysis

Priority Pass – A Great Business Model with Strong Network Effects

Summary: Priority Pass is a fantastic business with 1) strong network-effect barriers to entry in a growing industry and 2) plenty of new opportunities. I would invest in them if I could. What is Priority Pass? Priority Pass is paid membership program that provides individuals access to airport lounges. They are owned by the …

Continue reading "Priority Pass – A Great Business Model with Strong Network Effects"

My personal journey

$100,000 in Year 1 Revenue as Student Entrepreneurs – Our Personal Story

Starting a company is not easy. Business school is not cheap: $140,000 in tuition over 2 years, 2-4x that amount in foregone income. Plus, our classes and all those MBA social activities can take time away from the arduous task of company-building. Despite these challenges, there is enormous value in simultaneously pursuing an MBA & …

Continue reading "$100,000 in Year 1 Revenue as Student Entrepreneurs – Our Personal Story"